AP 1099 Payments

Description:

1099 Payments report showing payments made to 1099 reportable suppliers. This is the Blitz Report equivalent of the Oracle standard 1099 Payments Report (APXTRRVT).

The report lists suppliers from the 1099 tape data (vendors processed for 1099 reporting) along with their payment totals within the specified date range.

Key features:

- Uses ap_1099_tape_data to filter vendors processed for 1099 reporting

- Validates against Tax Reporting Entity and balancing segments

- Calculates payment amounts using Oracle AP_UTILITIES_PKG.Net_Invoice_Amount

- Determines tax reporting site (site with tax_reporting_site_flag=Y or first alphabetical site)

- Handles void checks by excluding payments voided within the date range

- Supports Summary (totals by supplier/type) and Detail (individual checks/invoices) modes

- MISC4 (Backup Withholding) amounts tracked separately as Withheld Amount

- Distribution Total shows gross amounts before withholding adjustments

- Payment Amount shows net reportable amounts (with MISC4 as negative)

- Query Driver parameter controls balancing segment matching (INV=invoice distribution, PAY=bank cash account)

- Employee vendors use national_identifier from per_all_people_f for tax ID

- Tax ID cleanup removes dashes, spaces, and treats 000000000 as blank

Parameters

Reporting Option, From Payment Date, To Payment Date, Tax Reporting Entity, Supplier Name, Income Tax Region, Federal Reportable Only, Query Driver

Used tables

ap_invoice_payments_all, ap_reporting_entities_all, ap_reporting_entity_lines_all, hr_operating_units, gl_ledgers, gl_code_combinations, ap_suppliers, ap_supplier_sites_all, per_all_people_f, ap_invoices_all, ap_invoice_distributions_all, ap_checks_all, ce_bank_acct_uses_all, ce_bank_accounts, ap_1099_tape_data

Categories

Dependencies

If you would like to try one of these Oracle EBS SQLs without having Blitz Report installed, note that some of the reports require functions from utility package xxen_util.

Example Report

AP 1099 Payments 28-Dec-2025 142614.xlsx

Report SQL

www.enginatics.com/reports/ap-1099-payments/

Blitz Report™ import options

Oracle E-Business Suite Reporting Library

We provide an open source Oracle EBS SQLs as a part of operational and project implementation support toolkits for rapid Excel reports generation.

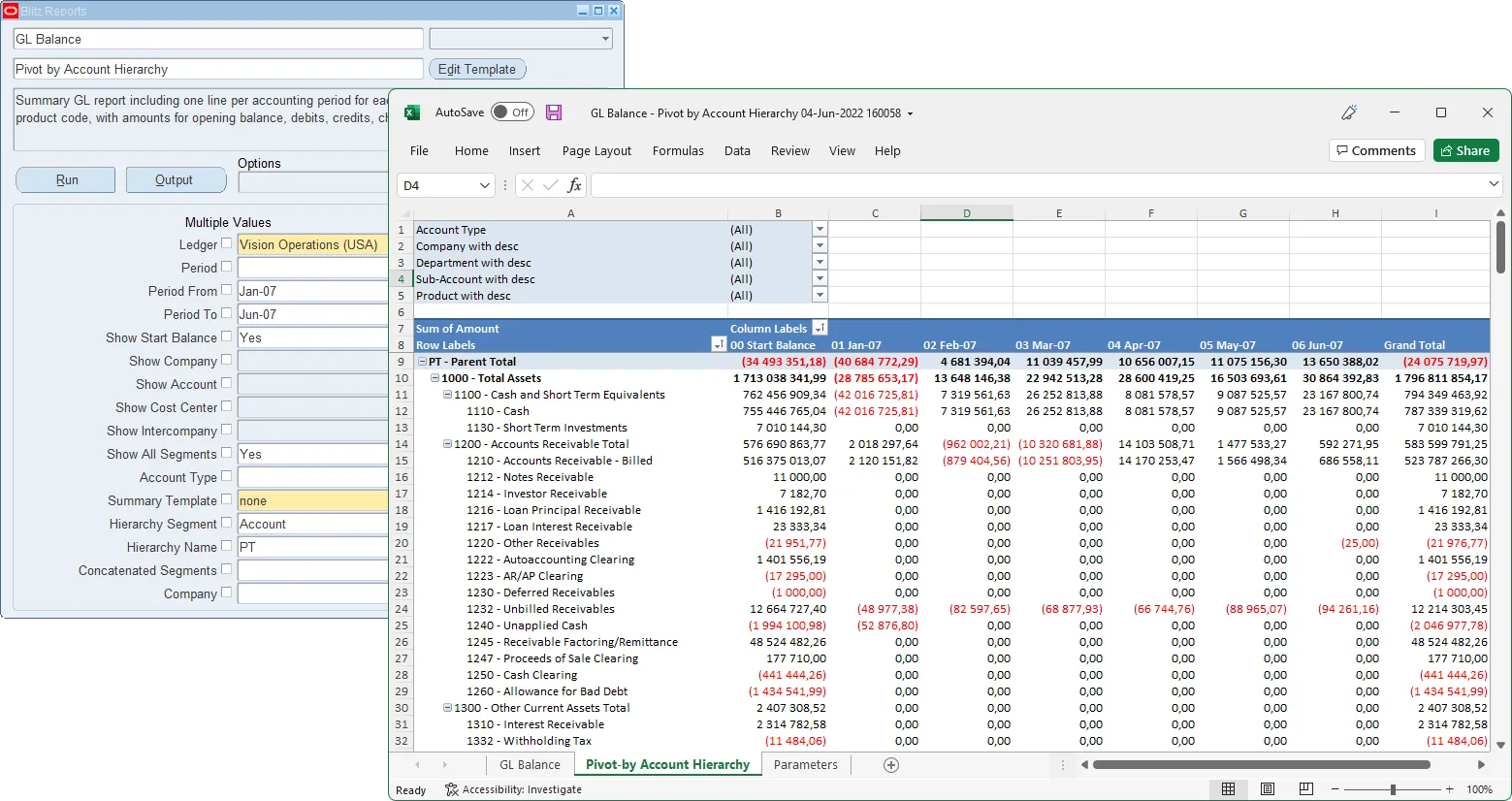

Blitz Report™ is based on Oracle EBS forms technology, and hence requires minimal training. There are no data or performance limitations since the output files are created directly from the database without going through intermediate file formats such as XML.

Blitz Report can be used as BI Publisher and Oracle Discoverer replacement tool. Standard Oracle BI Publisher and Discoverer reports can also be imported into Blitz Report for immediate output to Excel. Typically, reports can be created and version tracked within hours instead of days. The concurrent request output automatically opens upon completion without the need for re-formatting.

The Filters, Columns, Rows and Values fields are used to create and deliver the data in pivot table format with full drill down to details.

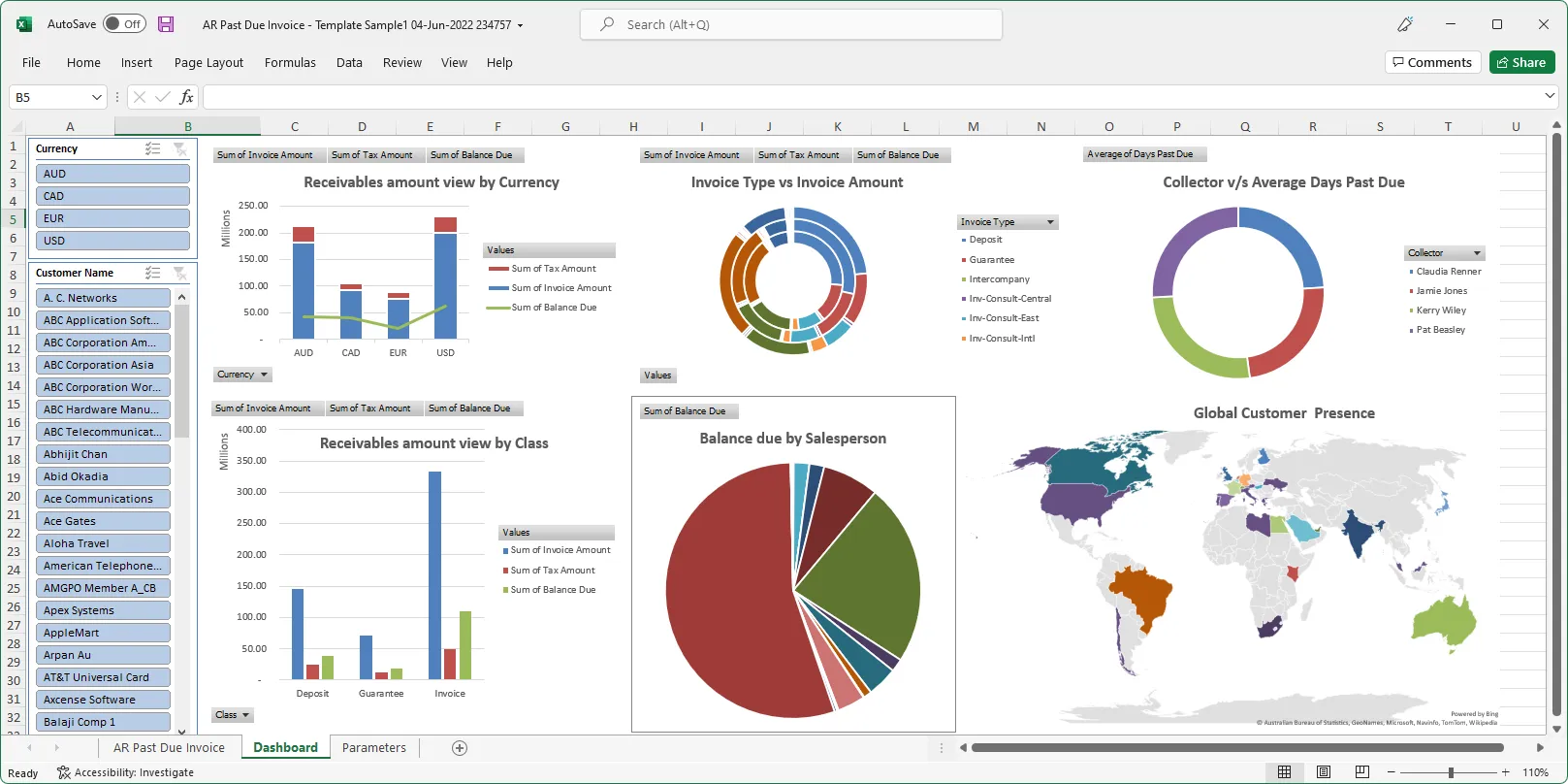

The Excel template upload functionality in Blitz Report allows users to create their own layouts by uploading an Excel template with additional sheets and charts, automatically refreshed when the report runs again. This allows to create custom dashboards and more advanced visualizations of report data.

You can download and use Blitz Report free of charge for your first 30 reports.

The installation and implementation process usually takes less than 1 hour; you can refer to our installation and user guides for specific details.

If you would like to optimize your Oracle EBS implementation and or operational reporting you can visit www.enginatics.com to review great ideas and example usage in blog. Or why not try for yourself in our demo environment.

Useful Links

Blitz Report™ – World’s fastest data upload and reporting for Oracle EBS

Oracle Discoverer replacement – importing worksheets into Blitz Report™

Blitz Report™ Questions & Answers

Supply Chain Hub by Blitz Report™

© 2025 Enginatics