AP Intercompany Invoice Details

Description:

AP Intercompany Invoice Details

Parameters

Ledger, Operating Unit, Supplier, Invoice Number, Invoice Type, Invoice Date From, Invoice Date To, Accounting Date From, Accounting Date To, Exclude Cancelled

Used tables

mtl_units_of_measure, ap_invoices_all, ap_invoice_lines_all, ap_invoice_distributions_all, ap_suppliers, ap_supplier_sites_all, hr_operating_units, gl_ledgers, gl_code_combinations_kfv, mtl_system_items_b_kfv, mtl_parameters

Categories

Dependencies

If you would like to try one of these Oracle EBS SQLs without having Blitz Report installed, note that some of the reports require functions from utility package xxen_util.

Example Report

Report SQL

www.enginatics.com/reports/ap-intercompany-invoice-details/

Blitz Report™ import options

AP_Intercompany_Invoice_Details.xml

Case Study & Technical Analysis: AP Intercompany Invoice Details

1. Executive Summary

Business Problem

Intercompany transactions are a common source of complexity in multi-entity organizations. Financial controllers and shared service centers often face challenges with:

- Reconciliation Discrepancies: Mismatches between intercompany receivables and payables.

- Transfer Pricing Compliance: Ensuring intercompany invoices reflect the correct transfer prices and markups.

- Tax Reporting: Accurately identifying and reporting intercompany VAT/GST.

- Consolidation Efficiency: Delays in month-end close due to the manual effort required to eliminate intercompany balances.

Solution Overview

The AP Intercompany Invoice Details report provides a granular view of intercompany AP invoices, linking them to the corresponding internal supplier and operating unit. It serves as a critical tool for reconciling intercompany balances and verifying transaction details.

Key Benefits

- Faster Reconciliation: Quickly identify and resolve discrepancies between billing and receiving entities.

- Audit Trail: Detailed record of all intercompany AP transactions for audit and tax purposes.

- Improved Accuracy: Validates that intercompany invoices are coded to the correct intercompany accounts.

- Global Visibility: Supports multi-org and multi-ledger reporting for a holistic view of intercompany exposure.

2. Functional Analysis

Report Purpose

This report extracts detailed information about AP invoices identified as intercompany transactions. It is designed to support the “Payables” side of the intercompany reconciliation process.

Key Metrics & Data Points

- Invoice Header: Invoice Number, Date, Type, Currency, Amount.

- Trading Partners: Buying Operating Unit (OU) vs. Selling Supplier (representing the internal entity).

- Line Details: Item description, quantity, unit price, and line amount.

- Accounting: Distribution accounts, specifically focusing on intercompany segments.

- Tax: Tax codes and amounts applied to the transaction.

Intended Audience

- Intercompany Accountants: To reconcile AP balances with AR counterparts.

- Corporate Controllers: To oversee the elimination of intercompany profit/loss.

- Tax Managers: To verify transfer pricing and tax application on internal trades.

- Shared Service Centers: To process and validate high volumes of internal invoices.

3. Technical Analysis

Source Tables

The report leverages standard AP tables joined with HR and GL definitions:

AP_INVOICES_ALL: Invoice headers.AP_INVOICE_LINES_ALL: Invoice lines (items, tax, freight).AP_INVOICE_DISTRIBUTIONS_ALL: Accounting distributions.AP_SUPPLIERS&AP_SUPPLIER_SITES_ALL: Supplier details (identifying internal suppliers).HR_OPERATING_UNITS: Organization context.GL_CODE_COMBINATIONS_KFV: Accounting flexfield segments.

Critical Logic

- Intercompany Identification: The report typically filters or highlights invoices based on the Supplier Type (e.g., ‘INTERCOMPANY’) or specific account ranges in the GL distribution.

- Multi-Org Access: Uses

MO_GLOBALor standard VPD policies to ensure the user sees data across all authorized operating units. - Currency Conversion: May include logic to show amounts in both transaction and functional currencies for reconciliation.

Performance Considerations

- Distribution Volume:

AP_INVOICE_DISTRIBUTIONS_ALLcan be very large. The report should be filtered by date range (Accounting DateorInvoice Date) to maintain performance. - Joins: Efficient joins to

GL_CODE_COMBINATIONSare essential for reporting on account segments.

4. Implementation Guide

Setup Instructions

- Deploy SQL: Import the SQL query into Blitz Report or your preferred tool.

- Define Intercompany Logic: Ensure your suppliers are correctly classified as ‘INTERCOMPANY’ or that you have a specific account segment for intercompany tracking to effectively use the report filters.

- Parameters:

Ledger/Operating Unit: Select the scope of the report.Date Range: Align with your financial period close cycle.Supplier: Filter for specific intercompany trading partners.

Usage Scenarios

- Pre-Close Review: Run 3 days before month-end to identify unmatched intercompany invoices.

- Reconciliation Meeting: Use the output to facilitate discussions between the AP team and the billing entity’s AR team.

- Tax Audit: Generate a fiscal year dump of all intercompany expenses for transfer pricing documentation.

5. Frequently Asked Questions (FAQ)

Q: How does the report know which invoices are “Intercompany”?

A: It typically relies on the Supplier Type setup in AP or specific GL account segments. Ensure your master data is accurate.

Q: Can I see the corresponding AR invoice number?

A: Standard AP reports don’t link directly to the external AR invoice unless it was captured in a specific reference field (e.g., INVOICE_NUM usually matches the AR invoice number).

Q: Does this include AGIS (Advanced Global Intercompany System) transactions?

A: This report focuses on AP Invoices. AGIS transactions that generate AP invoices will be included, but manual AGIS journals might not be, depending on the source.

Oracle E-Business Suite Reporting Library

We provide an open source Oracle EBS SQLs as a part of operational and project implementation support toolkits for rapid Excel reports generation.

Blitz Report™ is based on Oracle EBS forms technology, and hence requires minimal training. There are no data or performance limitations since the output files are created directly from the database without going through intermediate file formats such as XML.

Blitz Report can be used as BI Publisher and Oracle Discoverer replacement tool. Standard Oracle BI Publisher and Discoverer reports can also be imported into Blitz Report for immediate output to Excel. Typically, reports can be created and version tracked within hours instead of days. The concurrent request output automatically opens upon completion without the need for re-formatting.

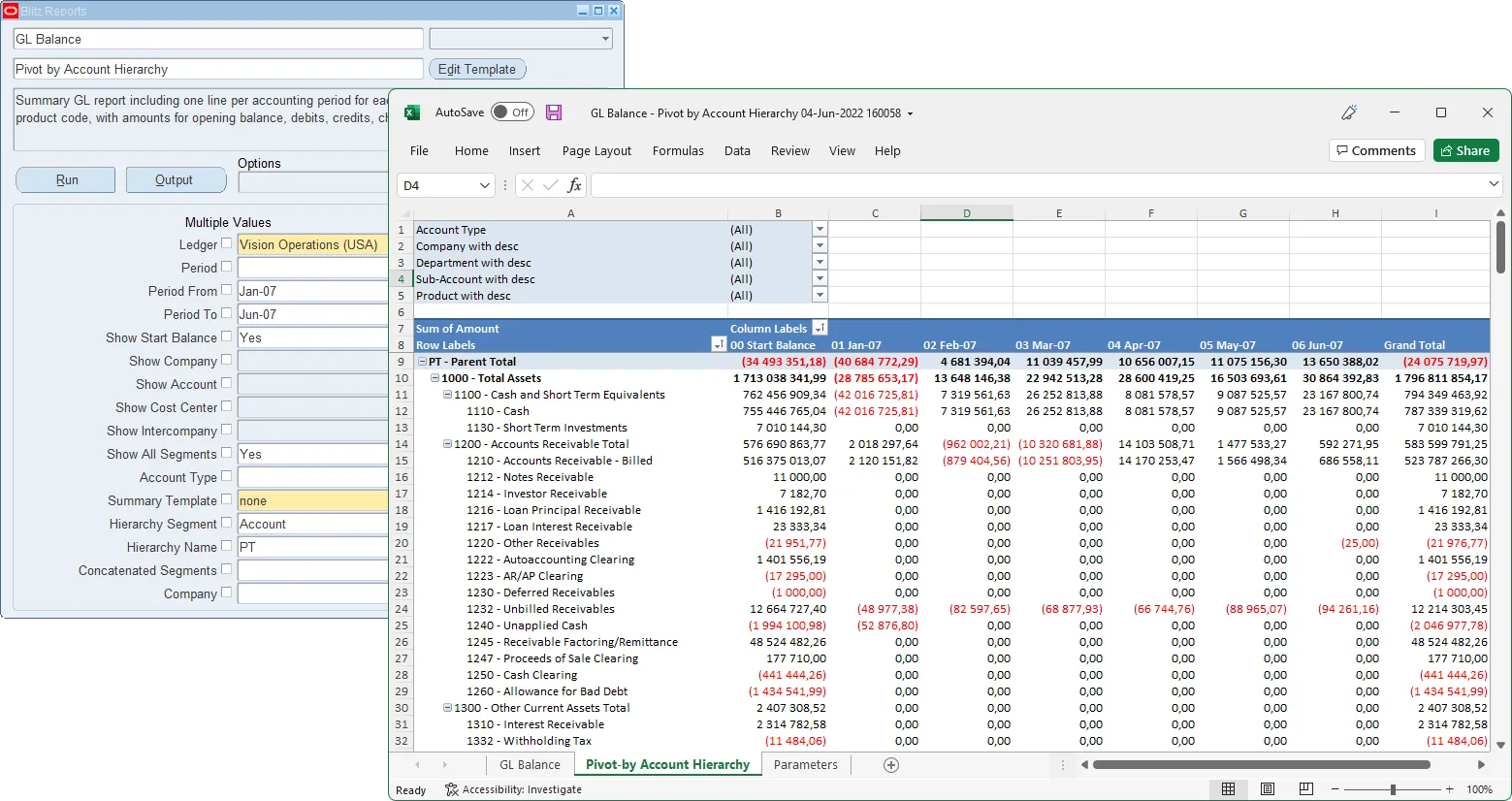

The Filters, Columns, Rows and Values fields are used to create and deliver the data in pivot table format with full drill down to details.

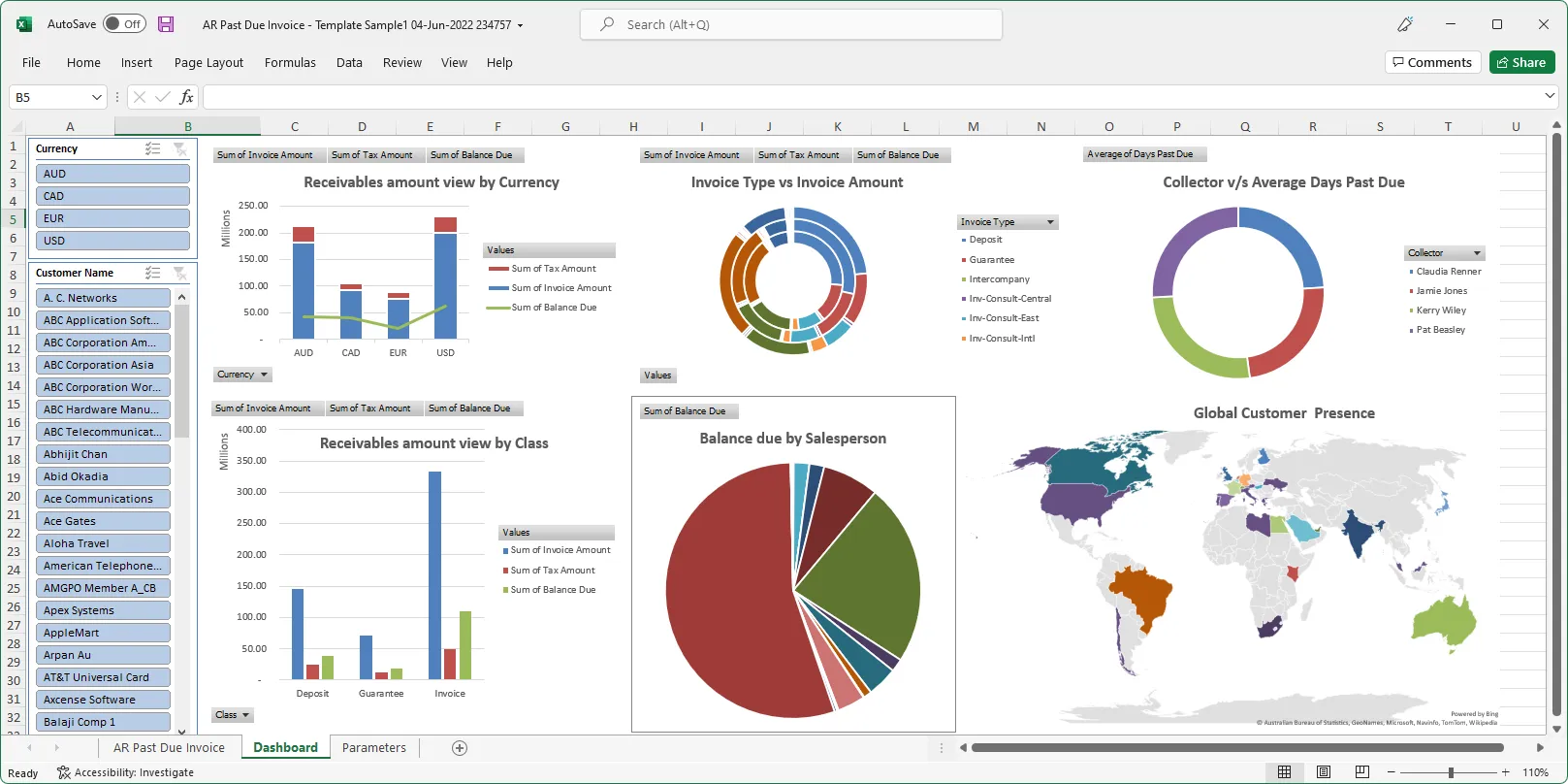

The Excel template upload functionality in Blitz Report allows users to create their own layouts by uploading an Excel template with additional sheets and charts, automatically refreshed when the report runs again. This allows to create custom dashboards and more advanced visualizations of report data.

You can download and use Blitz Report free of charge for your first 30 reports.

The installation and implementation process usually takes less than 1 hour; you can refer to our installation and user guides for specific details.

If you would like to optimize your Oracle EBS implementation and or operational reporting you can visit www.enginatics.com to review great ideas and example usage in blog. Or why not try for yourself in our demo environment.

Useful Links

Blitz Report™ – World’s fastest data upload and reporting for Oracle EBS

Oracle Discoverer replacement – importing worksheets into Blitz Report™

Blitz Report™ Questions & Answers

Supply Chain Hub by Blitz Report™

© 2025 Enginatics