AR Customer Credit Limits

Description:

Master data report for customer setup audit of credit amount limits and GL accounts for customer credit management and dunning notices.

Parameters

Display Level, Show Missing Credit Amounts, Operating Unit, Customer Name, Account Number, Show Receivables Balance, Show UnInvoiced Orders Balance, Sales Order Exchange Rate Type

Used tables

hz_customer_profiles, hr_all_organization_units_vl, hz_parties, hz_cust_accounts, hz_cust_acct_sites_all, hz_cust_site_uses_all, fnd_currencies, mo_glob_org_access_tmp, dual, hz_cust_profile_amts, hz_party_sites, hz_locations, fnd_territories_tl, ar_payment_schedules_all, gl_daily_conversion_types, oe_order_headers_all, oe_order_lines_all, hr_operating_units, gl_sets_of_books, ra_customer_trx_lines_all

Categories

Related reports

AR Customers and Sites, QP Customer Pricing Engine Request

Dependencies

If you would like to try one of these Oracle EBS SQLs without having Blitz Report installed, note that some of the reports require functions from utility package xxen_util.

Example Report

AR Customer Credit Limits 11-May-2017 123414.xlsx

Report SQL

www.enginatics.com/reports/ar-customer-credit-limits/

Blitz Report™ import options

AR Customer Credit Limits Report

Executive Summary

The AR Customer Credit Limits report provides a comprehensive overview of customer credit profiles, including credit limits, current balances, and other credit-related settings. This report is an essential tool for credit managers and accounts receivable teams, offering a centralized view of customer credit information that is critical for managing credit risk, making informed credit decisions, and ensuring the timely collection of receivables.

Business Challenge

Managing customer credit is a critical function for any organization that extends credit to its customers. However, many businesses face challenges in effectively managing customer credit, including:

- Lack of Visibility: Difficulty in getting a clear and up-to-date view of customer credit limits and current balances, which can lead to inconsistent credit decisions and an increased risk of bad debt.

- Manual Processes: The process of reviewing and approving customer credit limits can be time-consuming and manual, particularly in organizations with a large number of customers.

- Inconsistent Credit Policies: A lack of clear and consistent credit policies can lead to confusion and inconsistencies in the way that credit is managed across the organization.

- High Levels of Bad Debt: A lack of proactive credit management can lead to a high level of bad debt, which can have a significant impact on the bottom line.

The Solution

The AR Customer Credit Limits report provides a comprehensive and actionable view of customer credit information, helping organizations to:

- Improve Credit Management: By providing a clear and centralized view of customer credit information, the report enables credit managers to make more informed and consistent credit decisions.

- Reduce Credit Risk: By providing a timely and accurate view of customer balances and credit limits, the report helps to identify customers who may be at risk of default, enabling proactive measures to be taken to mitigate that risk.

- Streamline Credit Reviews: The report automates the process of gathering and reviewing customer credit information, which can save a significant amount of time and effort.

- Enhance Collections: By providing a clear view of customer balances and credit limits, the report can help to facilitate communication with customers and resolve payment issues in a timely and professional manner.

Technical Architecture (High Level)

The report is based on a query of several key tables in the Oracle Receivables and Oracle Trading Community Architecture (TCA) modules. The primary tables used include:

- hz_customer_profiles: This table stores the credit profile for each customer, including the credit limit, credit rating, and other credit-related information.

- hz_cust_accounts: This table contains information about the customer accounts.

- hz_parties: This table provides information about the parties associated with the customer accounts.

- ar_payment_schedules_all: This table is used to retrieve the current outstanding balance for each customer.

Parameters & Filtering

The report includes a variety of parameters that allow you to customize the output to your specific needs. The key parameters include:

- Operating Unit: Filter the report by a specific operating unit.

- Customer Name and Account Number: These parameters allow you to filter the report by a specific customer.

- Show Missing Credit Amounts: This parameter allows you to identify customers who do not have a credit limit defined.

- Show Receivables Balance: This parameter allows you to include the current outstanding receivables balance for each customer.

- Show UnInvoiced Orders Balance: This parameter allows you to include the value of uninvoiced sales orders for each customer.

Performance & Optimization

The AR Customer Credit Limits report is designed to be both efficient and flexible. It is optimized to use the standard indexes on the Oracle Receivables and TCA tables, which helps to ensure that the report runs quickly, even with large amounts of data.

FAQ

Q: Can I use this report to see the total credit exposure for a customer? A: Yes, the report can be configured to show the total credit exposure for a customer, which includes the current outstanding receivables balance and the value of uninvoiced sales orders.

Q: Can I use this report to identify customers who have exceeded their credit limit? A: Yes, the report can be used to identify customers who have exceeded their credit limit by comparing the current balance to the credit limit.

Q: Can I use this report to see the credit profile for a specific customer? A: Yes, you can use the “Customer Name” and “Account Number” parameters to filter the report and view the credit profile for a specific customer.

Oracle E-Business Suite Reporting Library

We provide an open source Oracle EBS SQLs as a part of operational and project implementation support toolkits for rapid Excel reports generation.

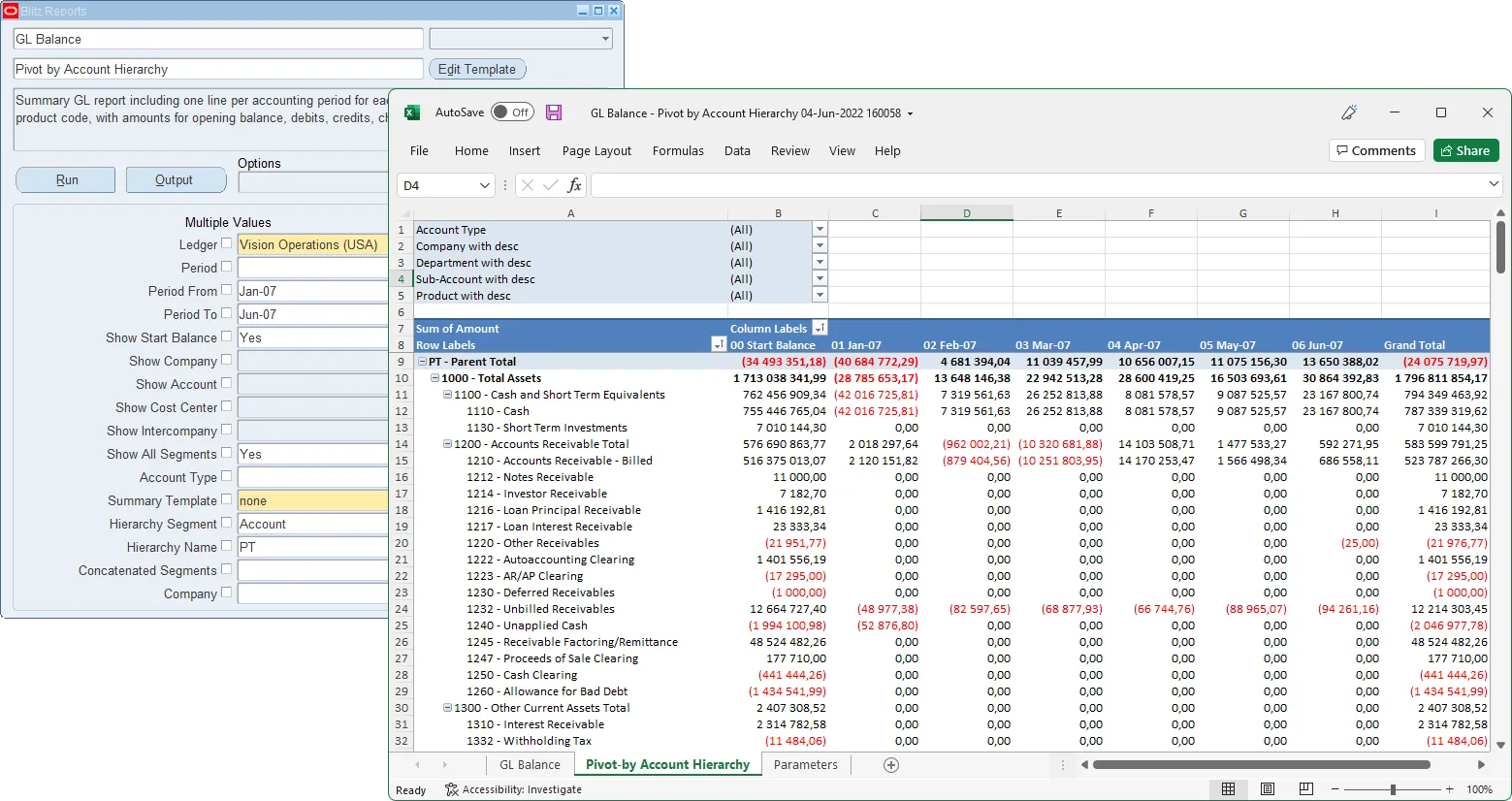

Blitz Report™ is based on Oracle EBS forms technology, and hence requires minimal training. There are no data or performance limitations since the output files are created directly from the database without going through intermediate file formats such as XML.

Blitz Report can be used as BI Publisher and Oracle Discoverer replacement tool. Standard Oracle BI Publisher and Discoverer reports can also be imported into Blitz Report for immediate output to Excel. Typically, reports can be created and version tracked within hours instead of days. The concurrent request output automatically opens upon completion without the need for re-formatting.

The Filters, Columns, Rows and Values fields are used to create and deliver the data in pivot table format with full drill down to details.

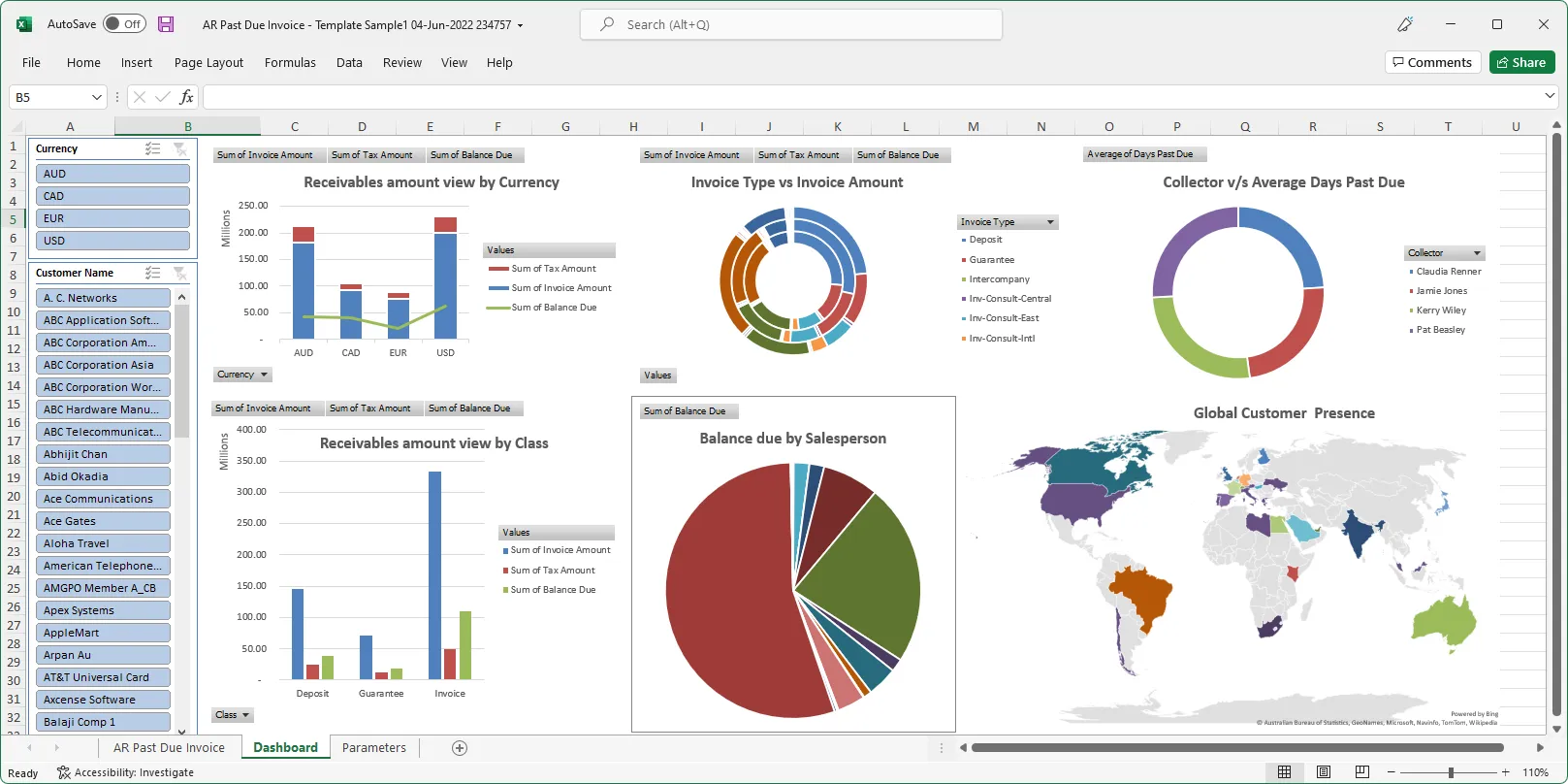

The Excel template upload functionality in Blitz Report allows users to create their own layouts by uploading an Excel template with additional sheets and charts, automatically refreshed when the report runs again. This allows to create custom dashboards and more advanced visualizations of report data.

You can download and use Blitz Report free of charge for your first 30 reports.

The installation and implementation process usually takes less than 1 hour; you can refer to our installation and user guides for specific details.

If you would like to optimize your Oracle EBS implementation and or operational reporting you can visit www.enginatics.com to review great ideas and example usage in blog. Or why not try for yourself in our demo environment.

Useful Links

Blitz Report™ – World’s fastest data upload and reporting for Oracle EBS

Oracle Discoverer replacement – importing worksheets into Blitz Report™

Blitz Report™ Questions & Answers

Supply Chain Hub by Blitz Report™

© 2025 Enginatics