AR Customer Open Balances Period Lookback

Description:

Report: AR Customer Open Balances Period Lookback Application: Receivables Description: Customer Open Balances summary showing

- Open Balances as of the specified ‘As of Date’ and as of

periods prior to the 'As of Date' period. - Maximum Open Balance in the prior

periods prior to the 'As of Date' period

All balances are show in the functional currency.

Parameters:

As of Date - the report will be run as of this date. Defaults to the current system date.

Look Back

Parameters

Ledger, Operating Unit, Currency, Customer, As of Date, Look Back

Used tables

ar_receivable_applications_all, ar_adjustments_all, gl_daily_conversion_types, gl_daily_rates, hr_operating_units, gl_ledgers, ra_customer_trx_all, ar_payment_schedules_all, ra_cust_trx_types_all, ra_cust_trx_line_gl_dist_all, hz_cust_accounts, hz_parties, ar_system_parameters_all, xle_entity_profiles, ar_lookups, ar_cash_receipts_all, ar_cash_receipt_history_all

Categories

Dependencies

If you would like to try one of these Oracle EBS SQLs without having Blitz Report installed, note that some of the reports require functions from utility package xxen_util.

Example Report

Report SQL

www.enginatics.com/reports/ar-customer-open-balances-period-lookback/

Blitz Report™ import options

AR_Customer_Open_Balances_Period_Lookback.xml

AR Customer Open Balances Period Lookback - Case Study & Technical Analysis

Executive Summary

The AR Customer Open Balances Period Lookback report is a powerful analytical tool for Oracle Receivables that provides a historical view of customer open balances. Unlike standard aging reports that offer a snapshot at a single point in time, this report allows financial analysts and credit managers to compare current open balances with those from previous periods. It also identifies the maximum open balance over a specified timeframe, offering critical insights into customer credit utilization trends and potential risk exposure.

Business Challenge

Managing accounts receivable effectively requires identifying trends in customer payment behavior. Organizations often struggle with:

- Trend Identification: Detecting whether a customer’s outstanding balance is increasing or decreasing over time can be difficult with standard static reports.

- Risk Forecasting: Predicting future bad debt requires understanding historical credit usage patterns.

- Credit Limit Management: Determining appropriate credit limits requires knowing not just the current balance, but also the peak credit usage in the past.

- Currency Fluctuations: For multi-national organizations, analyzing balances in a functional currency while accounting for exchange rate fluctuations is complex.

Solution

The AR Customer Open Balances Period Lookback report addresses these challenges by providing:

- Historical Comparison: Displays open balances as of a specific “As of Date” and compares them to balances from n periods prior.

- Peak Exposure Analysis: Calculates the maximum open balance reached during the lookback period, helping to assess the highest risk exposure for each customer.

- Trend Visibility: Enables users to spot customers with consistently growing balances, indicating potential collection issues.

- Multi-Currency Support: Reports balances in the functional currency, with options for revaluation to ensure accurate financial reporting.

Technical Architecture

The report is built on a robust SQL architecture that queries Oracle Receivables transaction and payment history tables.

Key Tables Used

AR_PAYMENT_SCHEDULES_ALL: The core table for tracking transaction balances and status.AR_RECEIVABLE_APPLICATIONS_ALL: Used to track how receipts and credit memos are applied to invoices, essential for calculating historical balances.AR_ADJUSTMENTS_ALL: Accounts for any adjustments made to transactions.HZ_CUST_ACCOUNTS&HZ_PARTIES: Provides customer master data.GL_DAILY_RATES: Used for currency conversion when reporting in a currency different from the transaction currency.GL_LEDGERS&HR_OPERATING_UNITS: Defines the organizational context for the report.

Data Logic

The report’s logic is sophisticated, involving:

- As-of Date Calculation: Determining the open balance of each transaction as of the specified date by subtracting applications and adjustments made after that date.

- Period Lookback: Repeating the balance calculation for n periods prior to the “As of Date” to provide comparative data.

- Max Balance Calculation: Iterating through the specified lookback periods to find the highest total open balance for each customer.

- Currency Revaluation: Applying revaluation rates if specified to present balances in a consistent currency.

Parameters

The report offers flexible parameters to tailor the analysis:

- As of Date: The reference date for the report (defaults to the current date).

- **Look Back

Periods:** The number of prior periods to compare against the current period. - **Max Open over last

Periods:** The number of periods to consider when calculating the maximum open balance. - Ledger / Operating Unit: Filters data by specific financial entities.

- Customer: Allows filtering for a specific customer or range of customers.

- Revaluation Currency / Rate Type / Date: Controls how foreign currency transactions are revalued.

Performance

To ensure high performance, especially when calculating historical balances across many periods:

- The query leverages indexes on

AR_PAYMENT_SCHEDULES_ALL(specifically oncustomer_idandgl_date) andAR_RECEIVABLE_APPLICATIONS_ALL. - It is recommended to run the report for specific operating units or customer ranges if the database volume is extremely high.

FAQ

Q: How is the “Open Balance” calculated for past periods? A: The report takes the original amount of the transaction and subtracts only those applications (receipts, credit memos) and adjustments that occurred on or before the period end date being analyzed.

Q: Does the “Max Open Balance” include unapplied cash? A: Typically, the calculation focuses on the gross open receivables (invoices, debit memos). However, depending on the specific configuration, it can be set to net out unapplied receipts.

Q: Why might the balance shown here differ from the GL balance? A: Differences can arise due to unposted items, manual journal entries in GL that are not reflected in AR, or differences in exchange rate types used for revaluation.

Oracle E-Business Suite Reporting Library

We provide an open source Oracle EBS SQLs as a part of operational and project implementation support toolkits for rapid Excel reports generation.

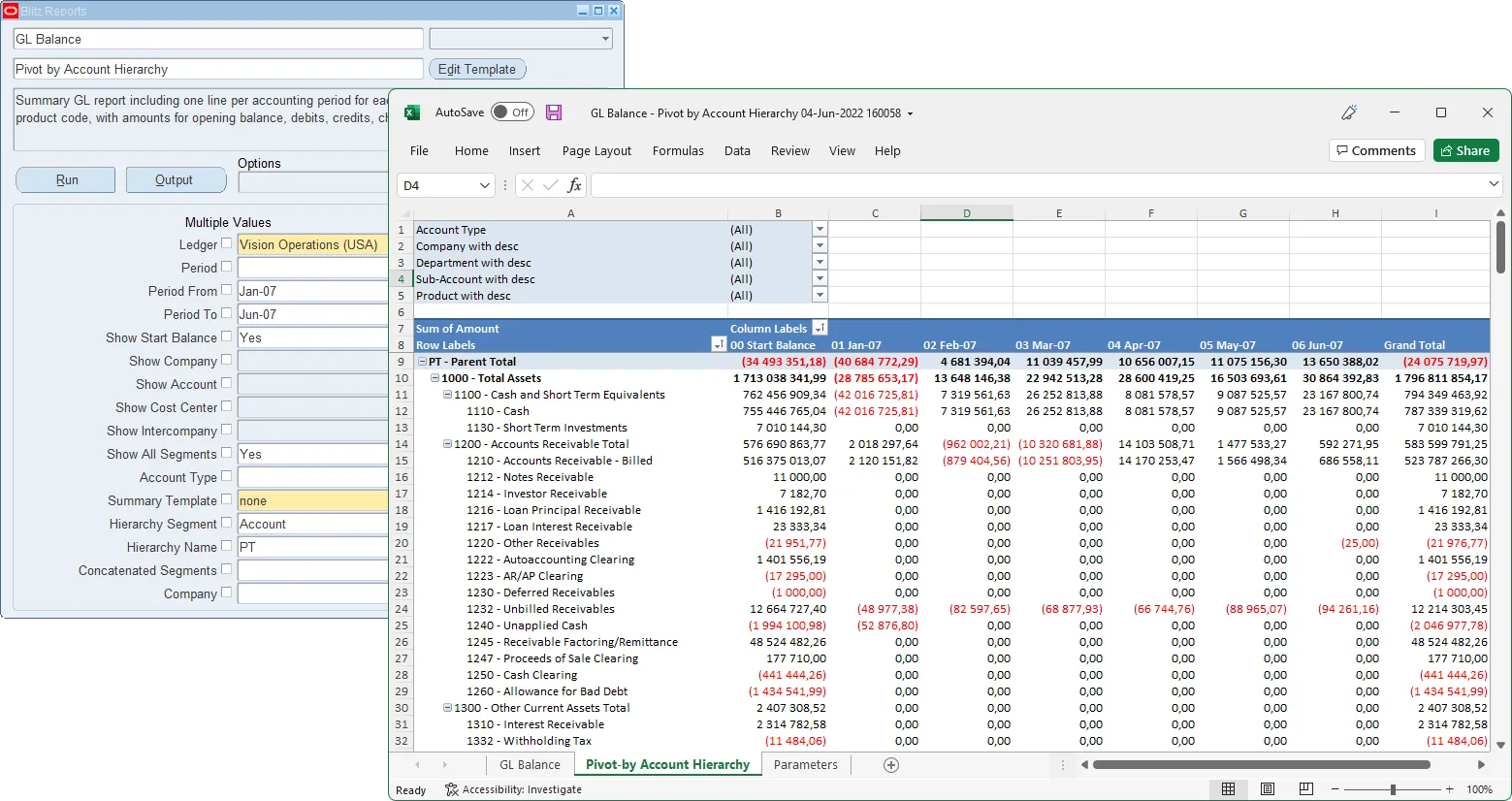

Blitz Report™ is based on Oracle EBS forms technology, and hence requires minimal training. There are no data or performance limitations since the output files are created directly from the database without going through intermediate file formats such as XML.

Blitz Report can be used as BI Publisher and Oracle Discoverer replacement tool. Standard Oracle BI Publisher and Discoverer reports can also be imported into Blitz Report for immediate output to Excel. Typically, reports can be created and version tracked within hours instead of days. The concurrent request output automatically opens upon completion without the need for re-formatting.

The Filters, Columns, Rows and Values fields are used to create and deliver the data in pivot table format with full drill down to details.

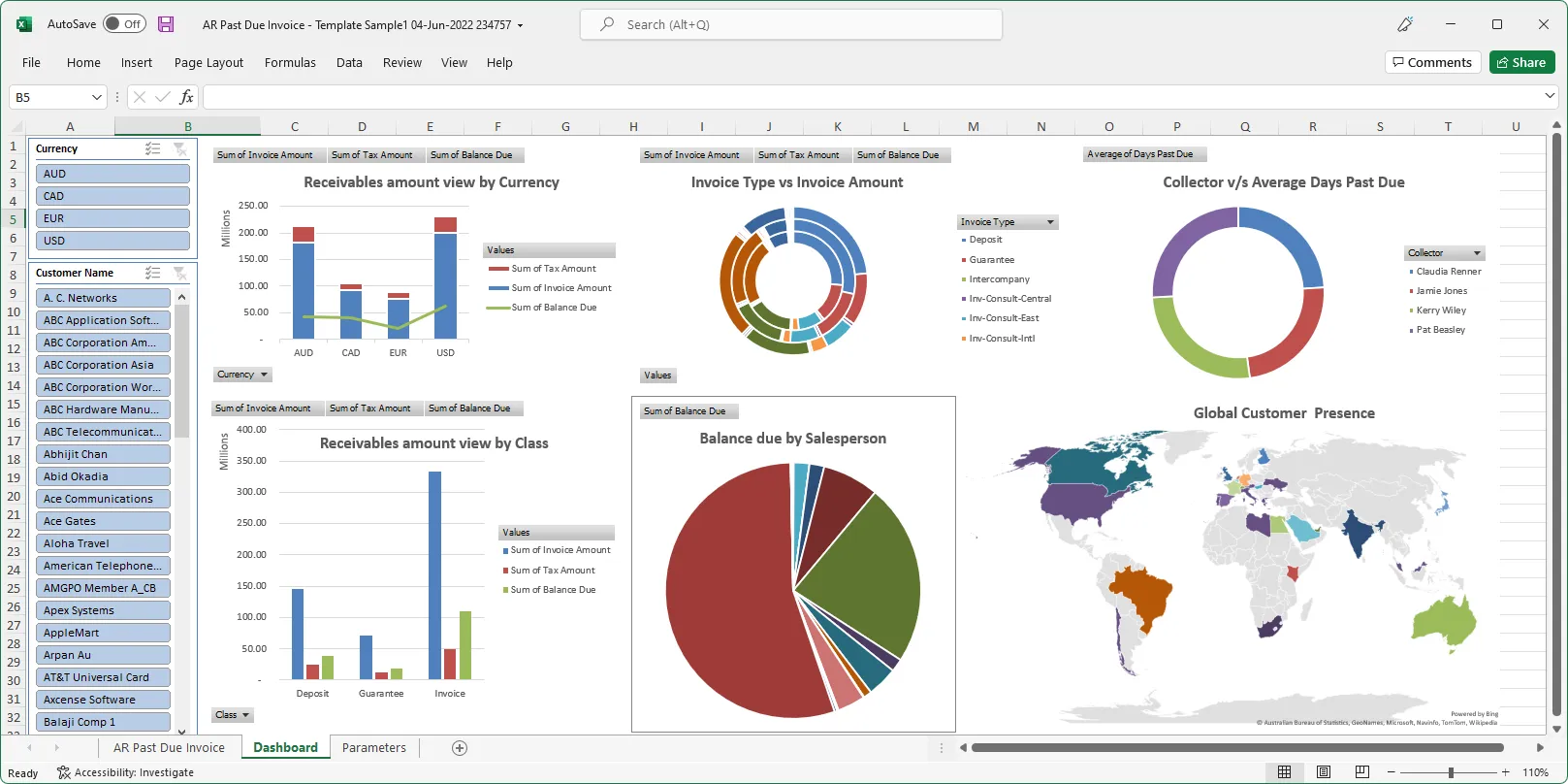

The Excel template upload functionality in Blitz Report allows users to create their own layouts by uploading an Excel template with additional sheets and charts, automatically refreshed when the report runs again. This allows to create custom dashboards and more advanced visualizations of report data.

You can download and use Blitz Report free of charge for your first 30 reports.

The installation and implementation process usually takes less than 1 hour; you can refer to our installation and user guides for specific details.

If you would like to optimize your Oracle EBS implementation and or operational reporting you can visit www.enginatics.com to review great ideas and example usage in blog. Or why not try for yourself in our demo environment.

Useful Links

Blitz Report™ – World’s fastest data upload and reporting for Oracle EBS

Oracle Discoverer replacement – importing worksheets into Blitz Report™

Blitz Report™ Questions & Answers

Supply Chain Hub by Blitz Report™

© 2025 Enginatics