AR Miscellaneous Receipts 11i

Description:

Receivables miscellaneous receipts

Parameters

Operating Unit, Receipt Method, Period, Receipt Date From, Receipt Date To, State, Customer Name, Account Number, Receipt Number

Used tables

ar_batches, ar_cash_receipts_all, ap_inv_selection_criteria_all, ap_checks_all, ra_customer_trx_all, hr_all_organization_units_vl, ar_cash_receipt_history_all, ar_receipt_methods, ap_bank_accounts_all, ap_bank_branches, ar_receivables_trx_all, hz_cust_accounts, hz_parties, hz_cust_site_uses_all, hz_cust_acct_sites_all, hz_party_sites, ar_distribution_sets_all

Categories

Related reports

AR Miscellaneous Receipts, GL Account Analysis (Distributions)

Dependencies

If you would like to try one of these Oracle EBS SQLs without having Blitz Report installed, note that some of the reports require functions from utility package xxen_util.

Example Report

Report SQL

www.enginatics.com/reports/ar-miscellaneous-receipts-11i/

Blitz Report™ import options

AR_Miscellaneous_Receipts_11i.xml

Case Study & Technical Analysis: AR Miscellaneous Receipts

1. Executive Summary

Business Problem

Miscellaneous receipts in Oracle Receivables represent cash inflows that are not directly related to customer invoices. These include interest income, investment returns, tax refunds, or stock sales. Because these transactions do not follow the standard “Invoice -> Receipt” matching process, they are often difficult to track, reconcile, and audit. Finance teams struggle with:

- Visibility: Lack of a centralized view for non-trade cash receipts.

- Reconciliation: Difficulty in tracing miscellaneous cash to the General Ledger, especially when complex distribution sets are used.

- Audit Compliance: Ensuring that all non-standard cash inflows are properly authorized, categorized, and accounted for.

- Tax Reporting: Identifying VAT or other taxes collected on miscellaneous income.

Solution Overview

The AR Miscellaneous Receipts report provides a detailed register of all non-invoice related cash receipts. It captures the entire lifecycle of the receipt, from creation to remittance and clearance. By exposing the underlying accounting distributions, tax codes, and reference information, it allows the Treasury and Accounting teams to fully validate and reconcile miscellaneous cash entries against bank statements and GL balances.

Key Benefits

- Complete Audit Trail: Tracks the status history of receipts (Approved, Remitted, Cleared, Reversed).

- Accounting Detail: Shows the specific GL accounts credited (e.g., Interest Income, Gain/Loss) for each receipt line.

- Tax Compliance: Identifies tax codes and amounts associated with taxable miscellaneous receipts.

- Reference Tracking: Links receipts to external reference numbers (e.g., Legacy System IDs, Check Numbers) for easier cross-referencing.

- Bank Reconciliation: Provides deposit dates and clearing dates to assist in month-end bank reconciliation.

2. Technical Analysis

Core Tables and Views

The report queries the core AR receipt tables:

AR_CASH_RECEIPTS_ALL: The primary header table for all receipts, including miscellaneous ones (identified bytype = 'MISC').AR_MISC_CASH_DISTRIBUTIONS_ALL: Stores the accounting distributions (GL accounts) for the miscellaneous receipt.AR_CASH_RECEIPT_HISTORY_ALL: Tracks the status changes (Creation -> Remittance -> Clearance) and the accounting date for each event.AR_RECEIVABLES_TRX_ALL: Defines the “Receivables Activity” (e.g., “Interest Income”) which drives the default accounting.AR_BATCHES_ALL: Links receipts to their batch if entered via a batch.GL_CODE_COMBINATIONS_KFV: Decodes the GL account segments.

SQL Logic and Data Flow

The SQL is designed to handle the one-to-many relationship between receipts and their distributions/history.

- Row Number Partitioning: Uses

row_number() over (partition by ...)to handle the display of amounts. This technique ensures that the header-level Receipt Amount is only displayed on the first distribution line to prevent double-counting in summations. - Status Decoding: Complex

DECODElogic is used to interpret theSTATUScolumns from both the receipt header and history tables, providing user-friendly statuses like ‘Reversed’, ‘Cleared’, etc. - Reference Resolution: A

CASEstatement resolves thereference_typeandreference_idto fetch human-readable values (e.g., if type is ‘PAYMENT’, it fetches the Check Number fromAP_CHECKS_ALL). - Bank Account Security: Joins to

IBY(Payments) tables (IBY_EXT_BANK_ACCOUNTS,IBY_CREDITCARD) to securely fetch masked bank account or credit card numbers.

Integration Points

- General Ledger: Validates the credited accounts via

AR_MISC_CASH_DISTRIBUTIONS_ALL. - Cash Management: Provides data for bank reconciliation (Bank Account, Deposit Date).

- Tax (E-Business Tax): Links to

AR_VAT_TAX_ALL(or the E-Business Tax repository in R12) for tax codes.

3. Functional Capabilities

Reporting Dimensions

- Receipt Source: Analyze receipts by “Activity” (e.g., Interest vs. Refund).

- Status: Filter by Receipt Status (e.g., Remitted, Cleared, Reversed).

- Time: Analyze cash inflows by GL Date, Receipt Date, or Deposit Date.

- Bank Account: Group receipts by the depositing Bank Account.

Key Parameters

- Date Ranges: GL Date, Receipt Date, Deposit Date.

- Receipt Method: Filter by Check, Wire, Cash, etc.

- Batch Name: Filter for specific receipt batches.

- Currency: Filter by Entered Currency.

4. Implementation Considerations

Best Practices

- Distribution Sets: Encourage the use of “Distribution Sets” in AR to standardize the accounting for common miscellaneous receipt types. This report can then be used to audit adherence to these standards.

- Reversal Tracking: Use the report to monitor reversed receipts, which can be an indicator of entry errors or potential fraud.

- Month-End: Run this report as part of the month-end close to ensure all miscellaneous cash is posted to the correct period and accounts.

Oracle E-Business Suite Reporting Library

We provide an open source Oracle EBS SQLs as a part of operational and project implementation support toolkits for rapid Excel reports generation.

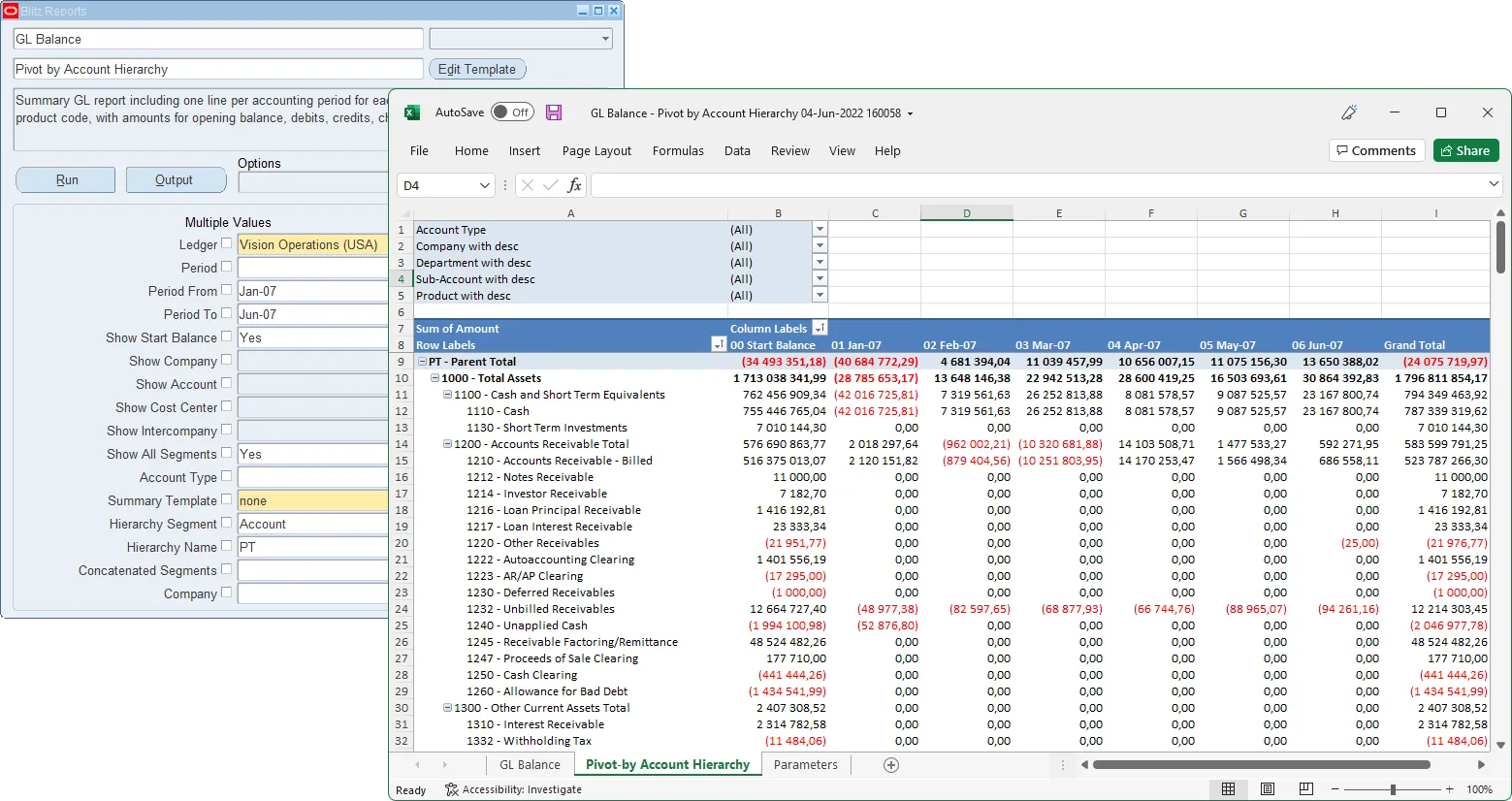

Blitz Report™ is based on Oracle EBS forms technology, and hence requires minimal training. There are no data or performance limitations since the output files are created directly from the database without going through intermediate file formats such as XML.

Blitz Report can be used as BI Publisher and Oracle Discoverer replacement tool. Standard Oracle BI Publisher and Discoverer reports can also be imported into Blitz Report for immediate output to Excel. Typically, reports can be created and version tracked within hours instead of days. The concurrent request output automatically opens upon completion without the need for re-formatting.

The Filters, Columns, Rows and Values fields are used to create and deliver the data in pivot table format with full drill down to details.

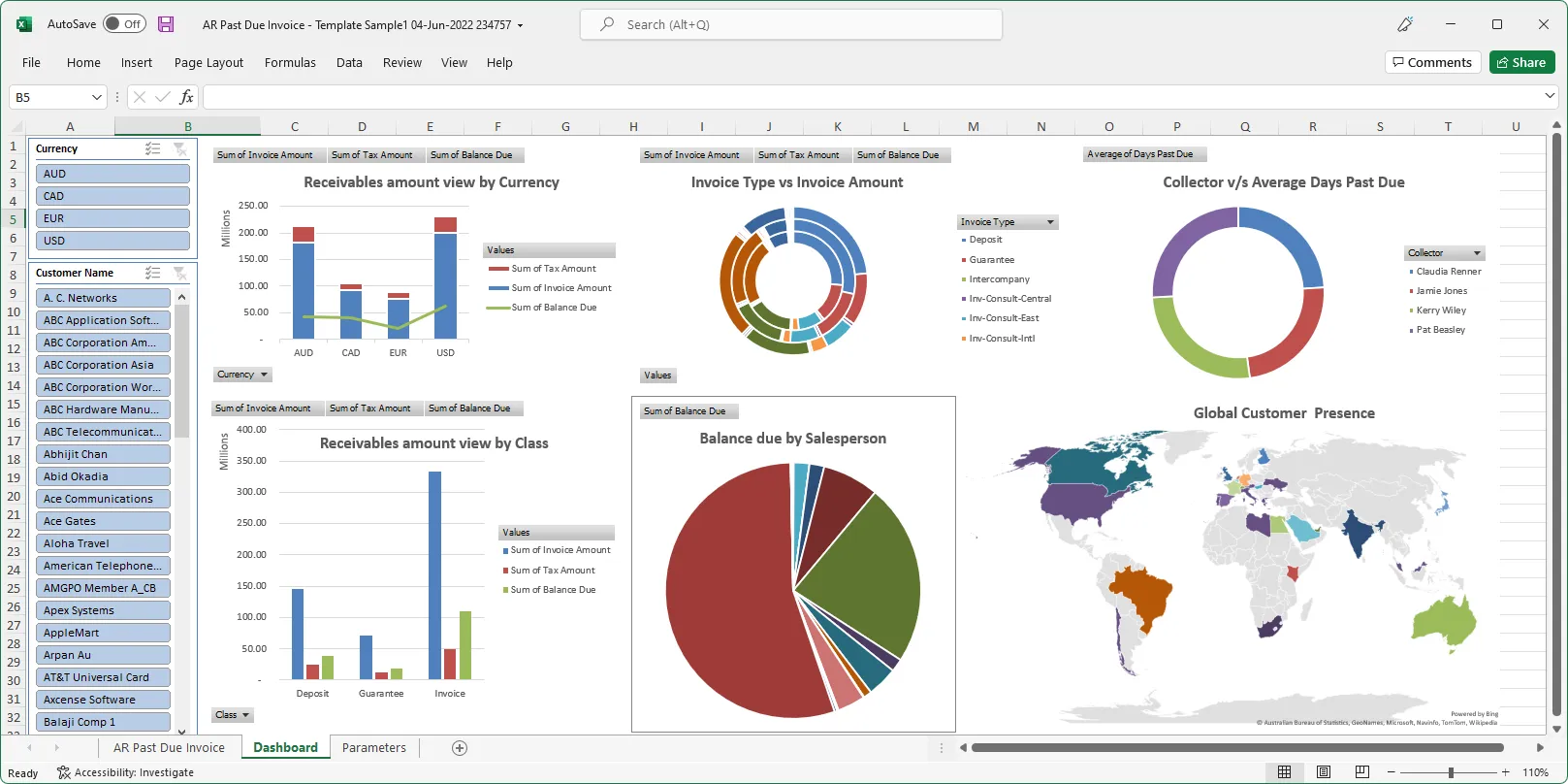

The Excel template upload functionality in Blitz Report allows users to create their own layouts by uploading an Excel template with additional sheets and charts, automatically refreshed when the report runs again. This allows to create custom dashboards and more advanced visualizations of report data.

You can download and use Blitz Report free of charge for your first 30 reports.

The installation and implementation process usually takes less than 1 hour; you can refer to our installation and user guides for specific details.

If you would like to optimize your Oracle EBS implementation and or operational reporting you can visit www.enginatics.com to review great ideas and example usage in blog. Or why not try for yourself in our demo environment.

Useful Links

Blitz Report™ – World’s fastest data upload and reporting for Oracle EBS

Oracle Discoverer replacement – importing worksheets into Blitz Report™

Blitz Report™ Questions & Answers

Supply Chain Hub by Blitz Report™

© 2025 Enginatics