CAC ICP PII WIP Pending Cost Adjustment

Description:

Report showing the potential standard cost changes for WIP discrete jobs, for the WIP completions, WIP component issues and WIP resource (labor) transactions, including gross costs, profit in inventory (commonly abbreviated as PII or ICP - InterCompany Profit). (Note that resource overheads / production overheads are not included in this report version.) The Cost Type (Old) defaults to your Costing Method Cost Type (Average, Standard, etc.); the Currency Conversion Dates default to the latest open or closed accounting period; and the To Currency Code and the Organization Code default from the organization code set for this session. And if you choose Yes for “Include All WIP Jobs” all WIP jobs will be reported even if there are no valuation changes.

– ================================================================= Copyright 2022 Douglas Volz Consulting, Inc. All rights reserved. Permission to use this code is granted provided the original author is acknowledged Original Author: Douglas Volz (doug@volzconsulting.com) – =================================================================

Hidden Parameters: p_sign_pii: Hidden parameter to set the sign of the profit in inventory amounts. This parameter determines if PII is normally entered as a positive or negative amount.

Displayed Parameters: Cost Type (New): the new cost type to be reported, mandatory Cost Type (Old): the old cost type to be reported, mandatory PII Cost Type (New): the new PII_Cost_Type you wish to report PII Cost Type(Old): the prior or old PII_Cost_Type you wish to report such as PII or ICP (mandatory) PII Sub-Element: the sub-element or resource for profit in inventory, such as PII or ICP (mandatory) Currency Conversion Date (New): the new currency conversion date, mandatory Currency Conversion Date (Old): the old currency conversion date, mandatory Currency Conversion Type (New): the desired currency conversion type to use for cost type 1, mandatory Currency Conversion Type (Old ): the desired currency conversion type to use for cost type 2, mandatory To Currency Code: the currency you are converting into Category Set 1: the first item category set to report, typically the Cost or Product Line Category_Set Category Set 2: the second item category set to report, typically the Inventory Category_Set All WIP Jobs: enter No to only report WIP jobs with valuation changes, enter Yes to report all WIP jobs. Org Code: specific inventory organization you wish to report (optional) Operating Unit: operating unit you wish to report, leave blank for all operating units (optional) Ledger: general ledger you wish to report, leave blank for all ledgers (optional)

| – | Version Modified on Modified by Description |

| – | ======= =========== ============== ========================================= |

| – | 1.6 08 Jun 2022 Douglas Volz Create PII version based on WIP Pending Cost Adjust Rept. |

Parameters

Cost Type (New), Cost Type (Old), PII Cost Type (New), PII Cost Type (Old), PII Sub-Element, Currency Conversion Date (New), Currency Conversion Type (New), Currency Conversion Date (Old), Currency Conversion Type (Old), To Currency Code, Category Set 1, Category Set 2, Category Set 3, Include All WIP Jobs, Organization Code, Operating Unit, Ledger

Used tables

Categories

Dependencies

If you would like to try one of these Oracle EBS SQLs without having Blitz Report installed, note that some of the reports require functions from utility package xxen_util.

Example Report

CAC ICP PII WIP Pending Cost Adjustment 23-Jun-2022 155341.xlsx

Report SQL

www.enginatics.com/reports/cac-icp-pii-wip-pending-cost-adjustment/

Blitz Report™ import options

CAC_ICP_PII_WIP_Pending_Cost_Adjustment.xml

Case Study & Technical Analysis: CAC ICP PII WIP Pending Cost Adjustment

Executive Summary

The CAC ICP PII WIP Pending Cost Adjustment report is a predictive financial tool designed for manufacturing organizations undergoing standard cost updates. It forecasts the financial impact of revaluing Work in Process (WIP) inventory, with a specific focus on Profit in Inventory (PII). By comparing “Old” (current) standard costs against “New” (proposed) standard costs, this report allows Finance to:

- Preview the P&L Impact: Calculate the potential revaluation gain/loss before running the official cost update.

- Isolate PII Movements: Specifically track how the intercompany profit portion of WIP value will change, ensuring that elimination entries remain accurate.

- Audit Cost Changes: Verify that proposed cost changes are applied correctly across all open WIP jobs.

Business Challenge

Changing standard costs in an Oracle EBS environment triggers an automatic revaluation of on-hand and WIP inventory.

- The “Black Box” Update: The standard

WIP Standard Cost Adjustmentprocess posts entries to the General Ledger but doesn’t provide a detailed, job-by-job breakdown of why the value changed, especially regarding PII. - Intercompany Complexity: For multinational corporations, a change in the transfer price of a component affects the PII embedded in every open job using that component. Finance needs to know if a $1M revaluation is due to genuine material cost changes or just a shift in intercompany profit.

- Month-End Surprise: Without this report, the revaluation entry is often a surprise at month-end. This report moves that analysis to the pre-close phase.

The Solution

This report simulates the revaluation logic used by the Oracle Cost Management engine.

- Dual Cost Type Comparison: It joins the WIP job components and assemblies to two distinct cost types (e.g., “Frozen” vs. “Pending”) to calculate the delta.

- Granular Analysis: It breaks down the revaluation by:

- WIP Completions: Finished goods sitting in WIP (moved to inventory but not yet closed).

- Component Issues: Raw materials issued to the job.

- Resources: Labor and overhead applied to the job.

- PII Isolation: It specifically looks for the PII cost element (defined by parameter) to report the “Profit” portion of the revaluation separately from the “Gross” cost change.

Technical Architecture (High Level)

The query constructs a “What-If” scenario by aggregating the current state of all open WIP jobs and pricing them twice.

sumwip(CTE): This is the core engine. It aggregates the three main sources of WIP value:- Net Assemblies: (Completions - Returns) * Standard Cost.

- Net Components: (Issues - Returns) * Standard Cost.

- Net Resources: (Applied) * Resource Rate.

- Cost Joins: The query joins

sumwiptoCST_ITEM_COSTStwice (aliased ascic1for New andcic2for Old). - PII Logic: It uses the

PII Cost TypeandPII Sub-Elementparameters to fetch the specific cost element representing profit fromCST_ITEM_COST_DETAILS.

Parameters & Filtering

- Cost Type (New/Old): The two snapshots to compare (e.g., “Pending” vs. “Frozen”).

- PII Cost Type (New/Old): The specific cost types holding the PII values (often the same as the main cost types, but can be separate).

- PII Sub-Element: The resource name used to tag PII (e.g., “ICP”, “PII”).

- Include All WIP Jobs: If “No”, filters out jobs with zero variance, focusing the user only on material changes.

Performance & Optimization

- Aggregation First: The query aggregates transactions in the

sumwipCTE before joining to the heavy cost tables. This significantly reduces the number of rows processed in the final join. - Materialized View Usage: It leverages

MTL_MATERIAL_TRANSACTIONSandWIP_TRANSACTION_ACCOUNTSlogic (simulated) to determine the current quantity balances in WIP.

FAQ

Q: Why does the report show a revaluation for “Resources”? A: If your labor rates or overhead rates are changing in the new cost type, the value of the labor already applied to open jobs will be revalued.

Q: Does this report update the costs? A: No, this is a reporting-only tool. It simulates the update. The actual update is performed by the “Update Standard Costs” concurrent program.

Q: What happens if a job has no PII? A: The “PII” columns will show 0, but the “Gross” columns will still show the standard cost impact. This allows the report to serve as a general-purpose revaluation preview tool, not just for PII.

Oracle E-Business Suite Reporting Library

We provide an open source Oracle EBS SQLs as a part of operational and project implementation support toolkits for rapid Excel reports generation.

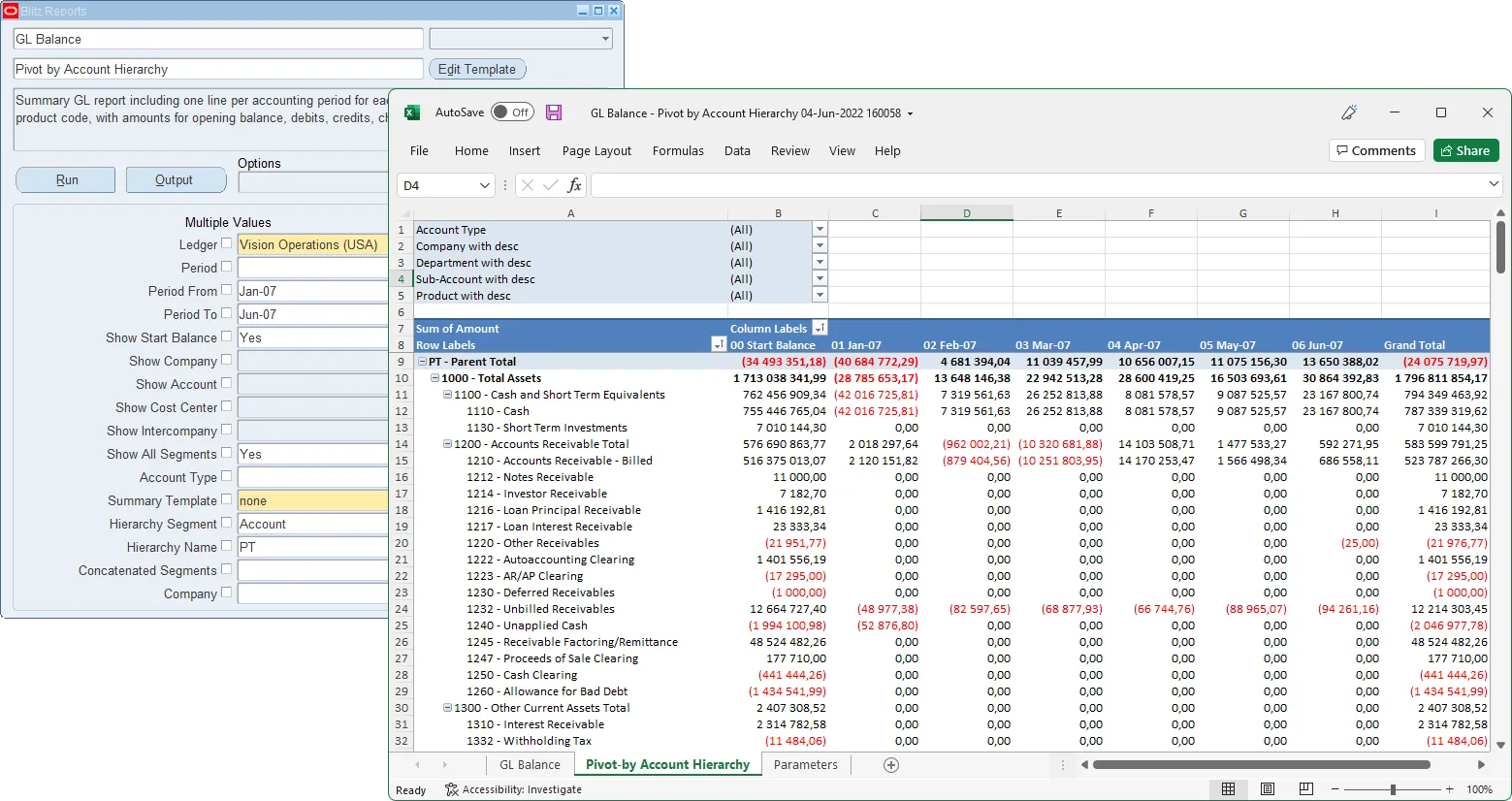

Blitz Report™ is based on Oracle EBS forms technology, and hence requires minimal training. There are no data or performance limitations since the output files are created directly from the database without going through intermediate file formats such as XML.

Blitz Report can be used as BI Publisher and Oracle Discoverer replacement tool. Standard Oracle BI Publisher and Discoverer reports can also be imported into Blitz Report for immediate output to Excel. Typically, reports can be created and version tracked within hours instead of days. The concurrent request output automatically opens upon completion without the need for re-formatting.

The Filters, Columns, Rows and Values fields are used to create and deliver the data in pivot table format with full drill down to details.

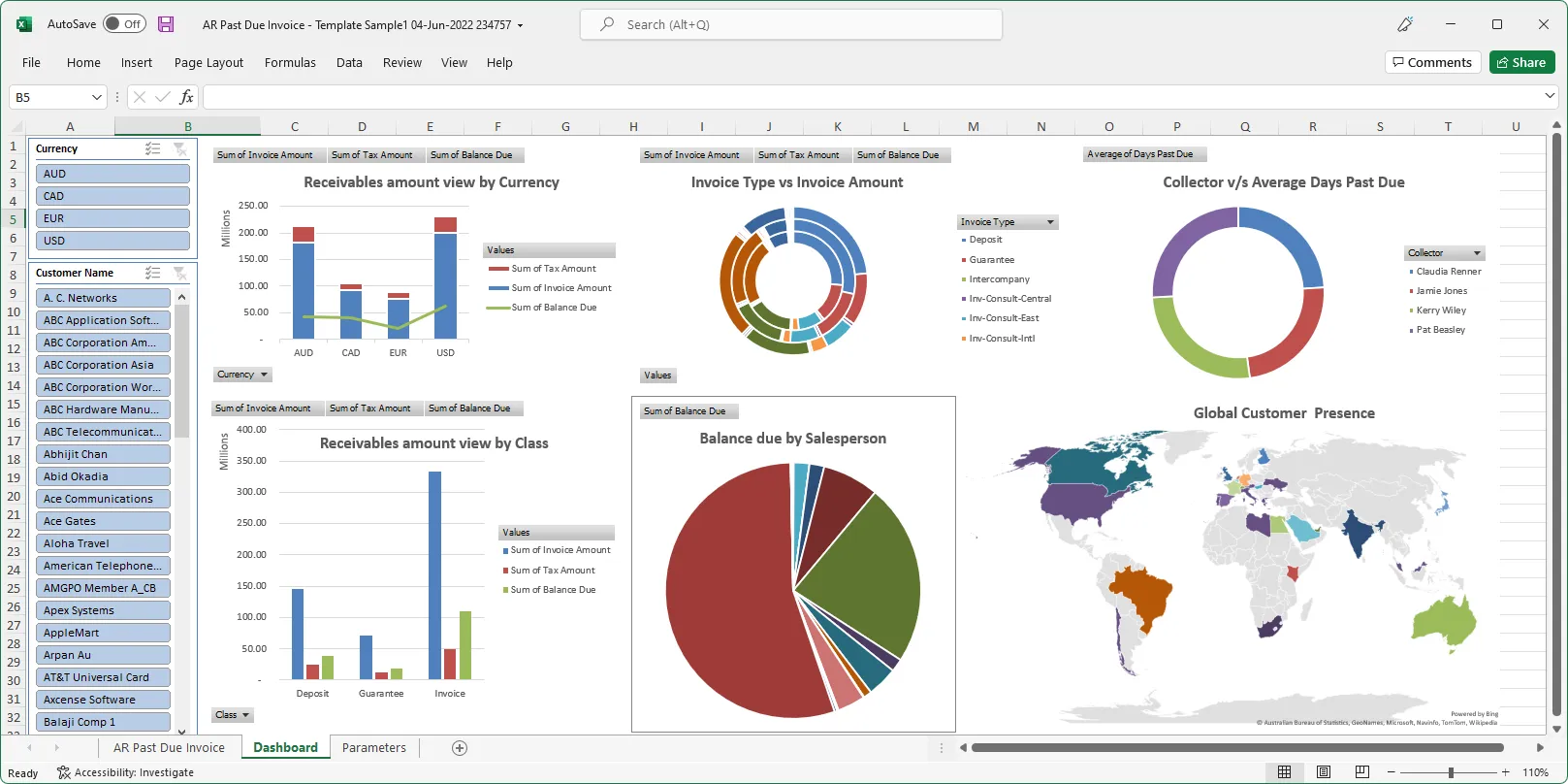

The Excel template upload functionality in Blitz Report allows users to create their own layouts by uploading an Excel template with additional sheets and charts, automatically refreshed when the report runs again. This allows to create custom dashboards and more advanced visualizations of report data.

You can download and use Blitz Report free of charge for your first 30 reports.

The installation and implementation process usually takes less than 1 hour; you can refer to our installation and user guides for specific details.

If you would like to optimize your Oracle EBS implementation and or operational reporting you can visit www.enginatics.com to review great ideas and example usage in blog. Or why not try for yourself in our demo environment.

Useful Links

Blitz Report™ – World’s fastest data upload and reporting for Oracle EBS

Oracle Discoverer replacement – importing worksheets into Blitz Report™

Blitz Report™ Questions & Answers

Supply Chain Hub by Blitz Report™

© 2025 Enginatics