FA Asset Additions

Description:

Imported from BI Publisher Description: Asset Additions Report Application: Assets Source: Asset Additions Report (XML) Short Name: FAS420_XML DB package: FA_FAS420_XMLP_PKG

Parameters

Ledger, Book, From Period Entered, To Period Entered, From Period Effective, To Period Effective, Category From, Category To

Used tables

fa_calendar_periods, fa_deprn_periods, fa_system_controls, fa_lookups, fa_additions, fa_asset_history, fa_transaction_headers, fa_category_books, fa_categories_b_kfv, fa_distribution_history, gl_code_combinations, &lp_fa_adjustments, &lp_fa_books, &lp_fa_deprn_summary, &lp_fa_deprn_detail, fnd_currencies, &lp_fa_book_controls, gl_sets_of_books, fa_book_controls_sec, &lp_fa_deprn_periods

Categories

Related reports

FA Asset Book Details, FA Asset Summary (Germany)

Dependencies

If you would like to try one of these Oracle EBS SQLs without having Blitz Report installed, note that some of the reports require functions from utility package xxen_util.

Example Report

FA Asset Additions 30-Aug-2021 051352.xlsx

Report SQL

www.enginatics.com/reports/fa-asset-additions/

Blitz Report™ import options

Case Study: Automating Fixed Asset Capitalization Reporting in Oracle EBS

Executive Summary

The FA Asset Additions report is a critical financial control tool designed to validate the capitalization of new assets within Oracle Fixed Assets. By providing a detailed audit trail of asset additions—including source details from Payables and Projects—this report ensures that organizations maintain an accurate asset register, comply with depreciation policies, and support rigorous tax reporting requirements.

Business Challenge

For asset-intensive organizations, the process of capitalizing assets (“Additions”) is a high-risk area for financial reporting. Inaccurate data during this phase can lead to incorrect depreciation calculations for years to come. Common challenges include:

- Source Traceability: Difficulty in tracing an asset back to its originating invoice or project cost, making audits time-consuming.

- Categorization Errors: Incorrect assignment of asset categories or depreciation methods at the time of addition.

- Period-End Bottlenecks: The need to manually verify hundreds of additions during the tight financial close window.

- Regulatory Compliance: Ensuring that all capitalized costs meet the specific criteria for asset recognition under GAAP or IFRS.

The Solution

The FA Asset Additions report provides a comprehensive view of all assets added within a specific period or range. It bridges the gap between the subsidiary ledgers (AP/PA) and the Fixed Assets module, offering immediate visibility into the “who, what, and when” of asset creation.

Key Features

- Source Line Detail: Links asset additions back to specific invoice lines or project tasks, providing a complete audit trail.

- Depreciation Validation: Displays the assigned depreciation method, life, and prorate conventions to ensure policy compliance.

- Multi-Book Support: Capable of reporting on different depreciation books (Corporate, Tax, etc.) to verify statutory reporting requirements.

- Cost Breakdown: Separates original cost, salvage value, and recoverable cost to validate the depreciable basis.

Technical Architecture

The report is built upon the core Oracle Fixed Assets transaction tables, ensuring data integrity and alignment with the standard FAS420 XML Publisher report but with enhanced accessibility.

Critical Tables

FA_ADDITIONS_B: Stores the descriptive information and asset category for each asset.FA_ASSET_HISTORY: Tracks changes to asset assignments and category information over time.FA_TRANSACTION_HEADERS: Records the specific transaction event (ADDITION) that created the asset.FA_BOOKS: Contains the financial rules (Cost, Method, Life) associated with the asset in a specific book.FA_DISTRIBUTION_HISTORY: Maps the asset to specific GL accounts and physical locations.

Key Parameters

- Book: The specific depreciation book to analyze (e.g., CORP, TAX, FED).

- From/To Period: The range of accounting periods to include in the report.

- Asset Category: Filter by specific asset types (e.g., COMPUTER-HARDWARE, VEHICLES).

- Asset Number: Capability to search for a specific asset for detailed auditing.

Functional Analysis

Use Cases

- Month-End Close: Accountants run this report to verify that all assets cleared from the CIP (Construction in Process) accounts have been correctly capitalized.

- Tax Reporting: Tax teams use the report to identify new additions for the year to calculate tax depreciation schedules.

- Internal Audit: Auditors use the source line details to sample asset additions and verify the existence of supporting documentation (invoices).

FAQ

Q: Does this report show assets added via Mass Additions? A: Yes, it includes assets added manually as well as those processed through the Mass Additions interface from Payables or Projects.

Q: Can I see the GL accounts associated with the addition?

A: Yes, the report joins to FA_DISTRIBUTION_HISTORY and GL_CODE_COMBINATIONS to show the expense and asset cost accounts.

Q: How does this compare to the standard FAS420 report? A: This SQL-based approach allows for easier export to Excel for pivot table analysis, whereas the standard XML/PDF output is static and harder to manipulate for large datasets.

Oracle E-Business Suite Reporting Library

We provide an open source Oracle EBS SQLs as a part of operational and project implementation support toolkits for rapid Excel reports generation.

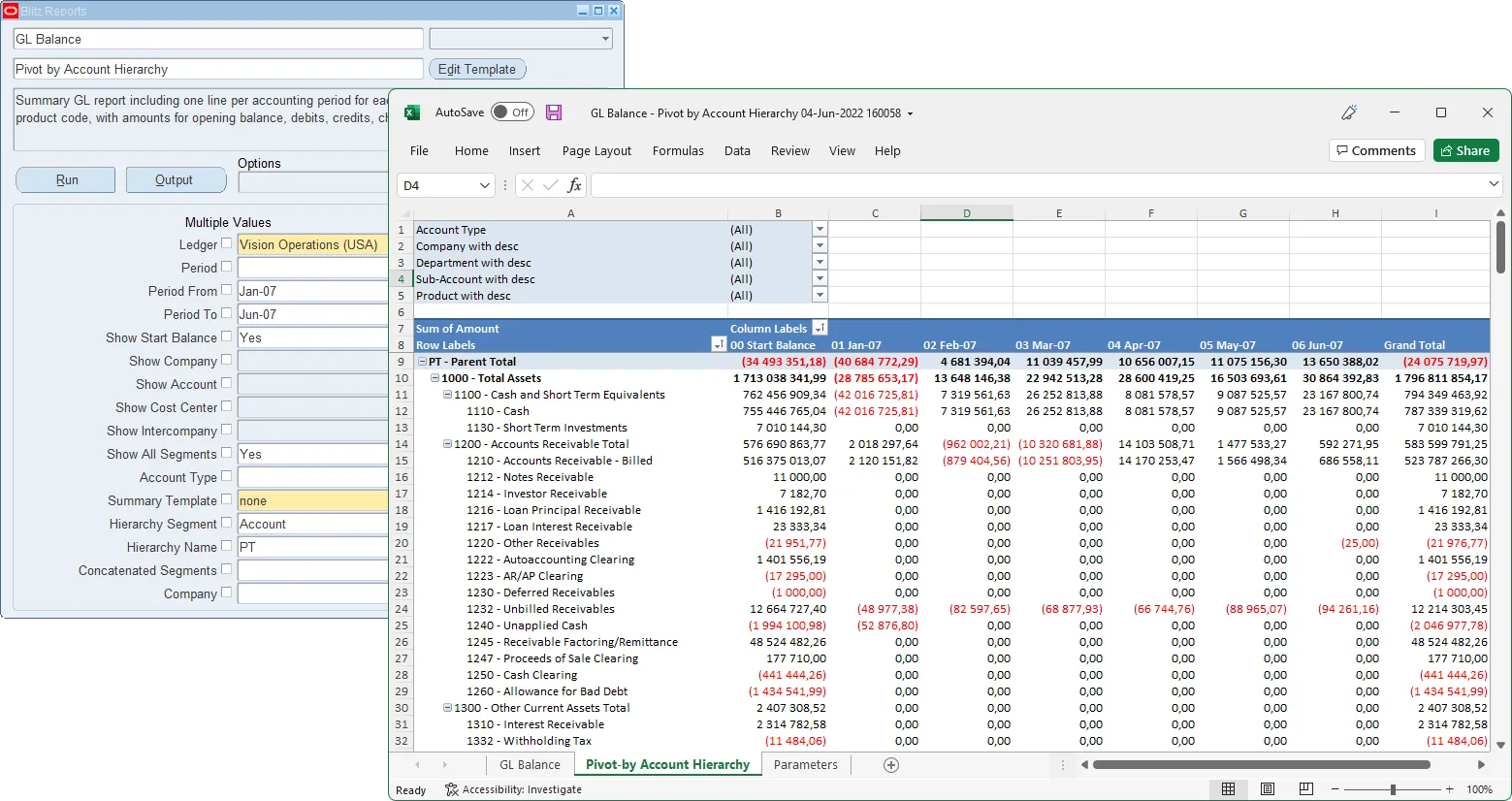

Blitz Report™ is based on Oracle EBS forms technology, and hence requires minimal training. There are no data or performance limitations since the output files are created directly from the database without going through intermediate file formats such as XML.

Blitz Report can be used as BI Publisher and Oracle Discoverer replacement tool. Standard Oracle BI Publisher and Discoverer reports can also be imported into Blitz Report for immediate output to Excel. Typically, reports can be created and version tracked within hours instead of days. The concurrent request output automatically opens upon completion without the need for re-formatting.

The Filters, Columns, Rows and Values fields are used to create and deliver the data in pivot table format with full drill down to details.

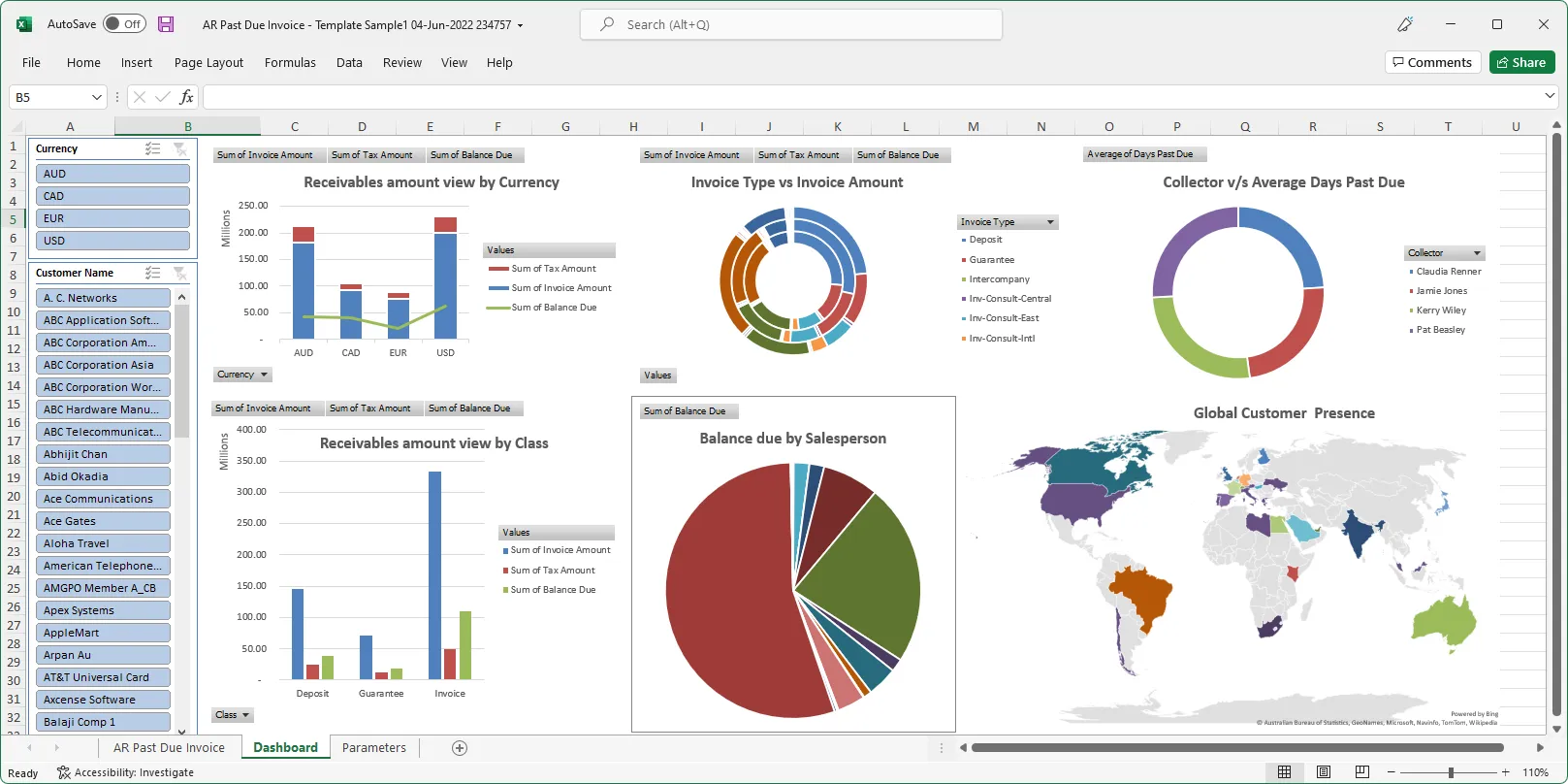

The Excel template upload functionality in Blitz Report allows users to create their own layouts by uploading an Excel template with additional sheets and charts, automatically refreshed when the report runs again. This allows to create custom dashboards and more advanced visualizations of report data.

You can download and use Blitz Report free of charge for your first 30 reports.

The installation and implementation process usually takes less than 1 hour; you can refer to our installation and user guides for specific details.

If you would like to optimize your Oracle EBS implementation and or operational reporting you can visit www.enginatics.com to review great ideas and example usage in blog. Or why not try for yourself in our demo environment.

Useful Links

Blitz Report™ – World’s fastest data upload and reporting for Oracle EBS

Oracle Discoverer replacement – importing worksheets into Blitz Report™

Blitz Report™ Questions & Answers

Supply Chain Hub by Blitz Report™

© 2025 Enginatics