FA Tax Reserve Ledger

Description:

Imported Oracle standard tax reserve ledger report Source: Tax Reserve Ledger Report (XML) Short Name: FAS480_XML DB package: FA_FAS480_XMLP_PKG Custom Package: XXEN_FA_FAS_XMLP

Parameters

Book, Set of Books Currency, Period

Used tables

fa_system_controls, gl_ledgers, fnd_currencies, fa_book_controls, fa_reserve_ledger_gt, fa_additions, gl_code_combinations, fa_fiscal_year

Categories

Dependencies

If you would like to try one of these Oracle EBS SQLs without having Blitz Report installed, note that some of the reports require functions from utility package xxen_util.

Example Report

FA Tax Reserve Ledger 30-Aug-2021 053238.xlsx

Report SQL

www.enginatics.com/reports/fa-tax-reserve-ledger/

Blitz Report™ import options

Executive Summary

The FA Tax Reserve Ledger is a critical report for tax reporting, specifically designed to reconcile the tax book’s depreciation reserve. It ensures that the accumulated depreciation for tax purposes is accurately recorded and matches the tax ledger.

Business Challenge

- Tax Compliance: Meeting the strict reporting requirements of tax authorities.

- Deferred Tax Calculation: Providing the data needed to calculate deferred tax assets or liabilities (the difference between book and tax depreciation).

- Audit Readiness: Having a clear, detailed ledger of tax depreciation for auditors.

The Solution

This Blitz Report mirrors the standard FAS480_XML report but delivers it in Excel for easier analysis:

- Tax Book Focus: Specifically targets tax books, which often have different depreciation rules than corporate books.

- Fiscal Year Alignment: Respects the fiscal year definitions associated with the tax book.

- Detailed Listing: Shows the reserve movement for each asset within the tax book.

Technical Architecture

The report uses FA_RESERVE_LEDGER_GT to capture the depreciation run details. It joins with FA_FISCAL_YEAR to ensure the reporting period aligns with the tax year, which may differ from the corporate fiscal year.

Parameters & Filtering

- Book: The tax depreciation book.

- Period: The period to report on.

Performance & Optimization

- Run Timing: Should be run after the tax book depreciation is closed for the period.

- Data Volume: Tax books often contain the same assets as corporate books, so data volume is similar.

FAQ

- Q: Can I run this for a corporate book?

- A: Yes, technically, but the “Journal Entry Reserve Ledger” is usually preferred for corporate books. This report is labeled “Tax” to indicate its typical use case.

- Q: Why are the amounts different from the Corporate book?

- A: Tax books usually use accelerated depreciation methods (like MACRS) compared to straight-line in corporate books, leading to different reserve balances.

Oracle E-Business Suite Reporting Library

We provide an open source Oracle EBS SQLs as a part of operational and project implementation support toolkits for rapid Excel reports generation.

Blitz Report™ is based on Oracle EBS forms technology, and hence requires minimal training. There are no data or performance limitations since the output files are created directly from the database without going through intermediate file formats such as XML.

Blitz Report can be used as BI Publisher and Oracle Discoverer replacement tool. Standard Oracle BI Publisher and Discoverer reports can also be imported into Blitz Report for immediate output to Excel. Typically, reports can be created and version tracked within hours instead of days. The concurrent request output automatically opens upon completion without the need for re-formatting.

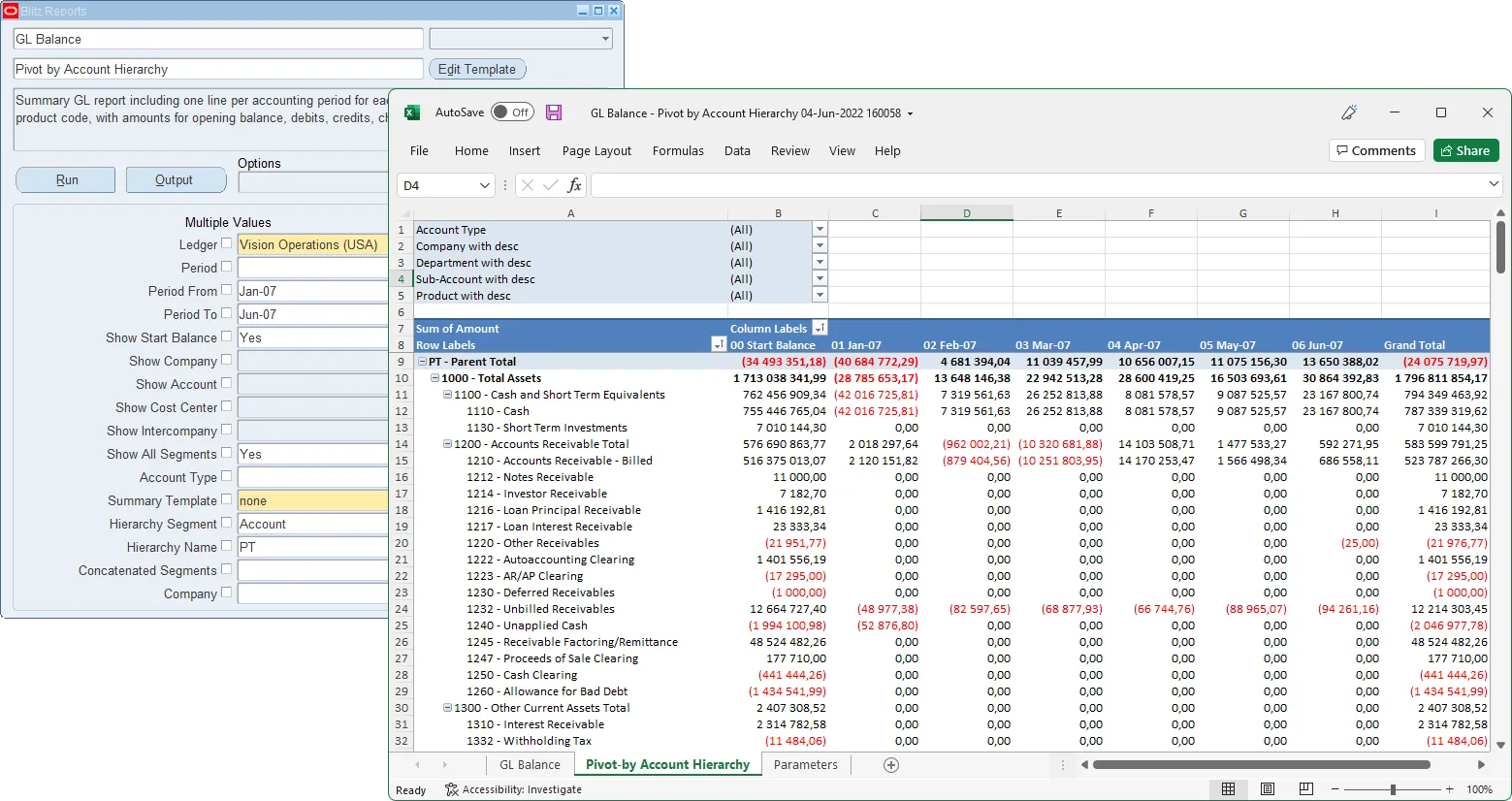

The Filters, Columns, Rows and Values fields are used to create and deliver the data in pivot table format with full drill down to details.

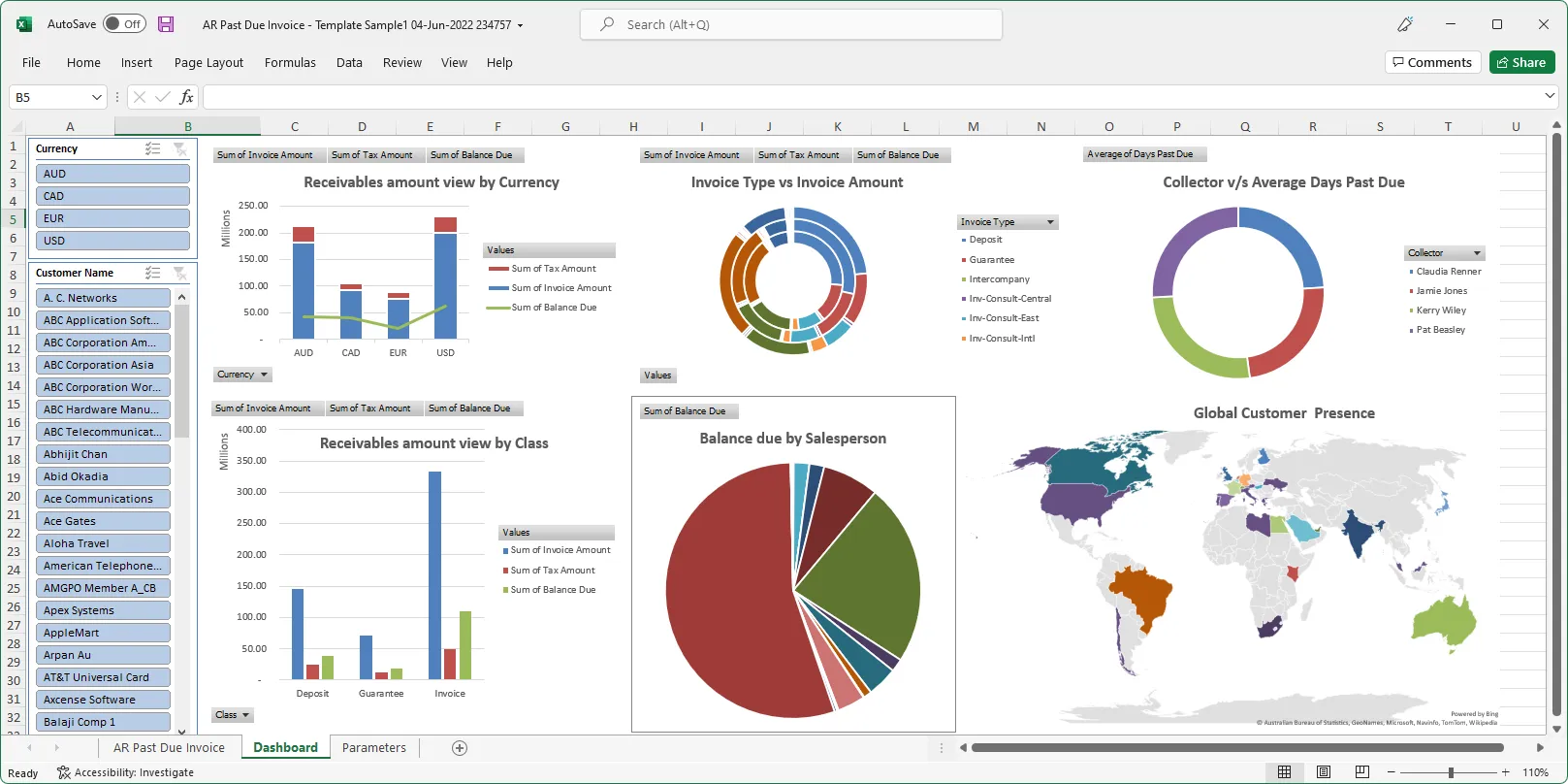

The Excel template upload functionality in Blitz Report allows users to create their own layouts by uploading an Excel template with additional sheets and charts, automatically refreshed when the report runs again. This allows to create custom dashboards and more advanced visualizations of report data.

You can download and use Blitz Report free of charge for your first 30 reports.

The installation and implementation process usually takes less than 1 hour; you can refer to our installation and user guides for specific details.

If you would like to optimize your Oracle EBS implementation and or operational reporting you can visit www.enginatics.com to review great ideas and example usage in blog. Or why not try for yourself in our demo environment.

Useful Links

Blitz Report™ – World’s fastest data upload and reporting for Oracle EBS

Oracle Discoverer replacement – importing worksheets into Blitz Report™

Blitz Report™ Questions & Answers

Supply Chain Hub by Blitz Report™

© 2025 Enginatics