JA India GSTR-3B Return

Description:

Imported from BI Publisher Description: GSTR-3B Return Report Application: Asia/Pacific Localizations Source: India GSTR-3B Return Report Short Name: JAIGSTR3B DB package:

Parameters

Tax Regime, GST Registration Number, Return Period (MONYYYY), Legal Name

Used tables

jai_party_reg_lines_v, jai_party_regs_v, jai_tax_det_factors, party, jai_tax_lines_v, jai_reporting_associations_v, jai_rgm_recovery_lines, jai_party_regs, jai_tax_types_v, dual, jai_tax_lines

Categories

Dependencies

If you would like to try one of these Oracle EBS SQLs without having Blitz Report installed, note that some of the reports require functions from utility package xxen_util.

Example Report

Report SQL

www.enginatics.com/reports/ja-india-gstr-3b-return/

Blitz Report™ import options

JA India GSTR-3B Return - Case Study & Technical Analysis

Executive Summary

The JA India GSTR-3B Return report supports the filing of the monthly summary return. GSTR-3B is a self-declared summary of outward supplies, inward supplies liable to reverse charge, and eligible ITC. It is the return that determines the actual tax payment liability for the month.

Business Challenge

GSTR-3B is the “Payment Return”. Errors here directly result in incorrect tax payments.

- Summary View: Unlike GSTR-1 (detailed), GSTR-3B requires consolidated figures.

- Liability Calculation: “Output Tax - Input Tax Credit = Cash Payment”. This calculation must be precise.

- Reverse Charge: Identifying services (like Legal Fees or Transport) where the company must pay tax on behalf of the vendor.

Solution

The JA India GSTR-3B Return report aggregates data from both Sales (GSTR-1 equivalent) and Purchases (GSTR-2 equivalent) to provide the summary figures needed for the 3B filing.

Key Features:

- Consolidated Outward Supplies: Total Taxable Value and Tax for sales.

- Eligible ITC: Summary of ITC available from imports, ISDT, and domestic purchases.

- Reverse Charge Liability: Summarizes liability arising from RCM (Reverse Charge Mechanism).

Technical Architecture

The report aggregates data from the GST transaction repository.

Key Tables and Views

JAI_TAX_DET_FACTORS: Tax determination factors.JAI_TAX_LINES: Tax amounts.JAI_RGM_RECOVERY_LINES: Repository for tax recovery/payment.

Core Logic

- Aggregation: Sums up taxable values and tax amounts by category (Outward, Inward RCM, ITC).

- Netting: (In the business process, not necessarily the report) Calculates the net liability.

- Reporting: Presents the data in the exact table format of the GSTR-3B online form (Table 3.1, Table 4, etc.).

Business Impact

- Tax Payment: The basis for the monthly GST payment to the government.

- Compliance: Ensures the monthly return is filed accurately and on time.

- Financial Planning: Provides visibility into the net cash outflow required for taxes.

Oracle E-Business Suite Reporting Library

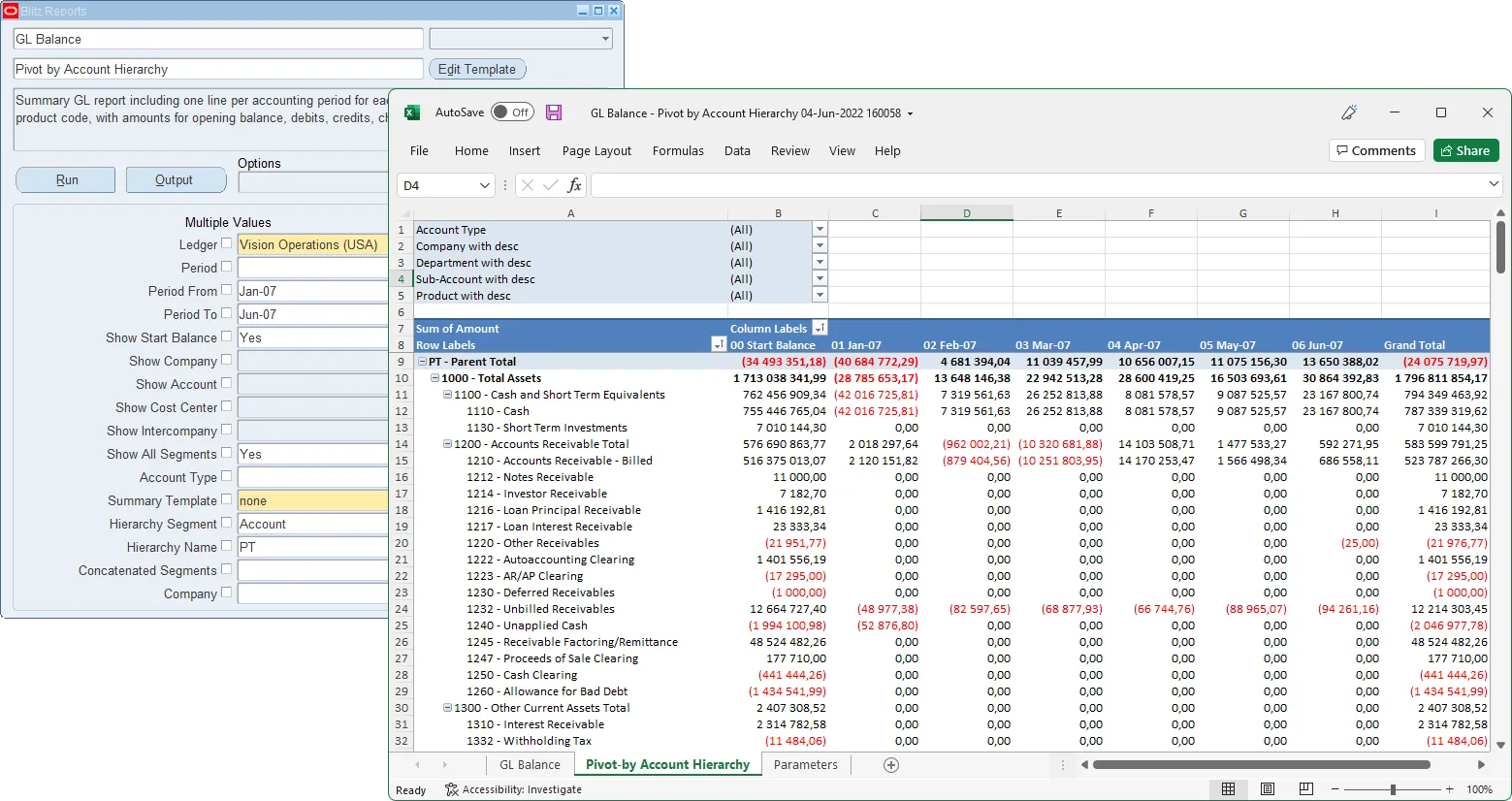

We provide an open source Oracle EBS SQLs as a part of operational and project implementation support toolkits for rapid Excel reports generation.

Blitz Report™ is based on Oracle EBS forms technology, and hence requires minimal training. There are no data or performance limitations since the output files are created directly from the database without going through intermediate file formats such as XML.

Blitz Report can be used as BI Publisher and Oracle Discoverer replacement tool. Standard Oracle BI Publisher and Discoverer reports can also be imported into Blitz Report for immediate output to Excel. Typically, reports can be created and version tracked within hours instead of days. The concurrent request output automatically opens upon completion without the need for re-formatting.

The Filters, Columns, Rows and Values fields are used to create and deliver the data in pivot table format with full drill down to details.

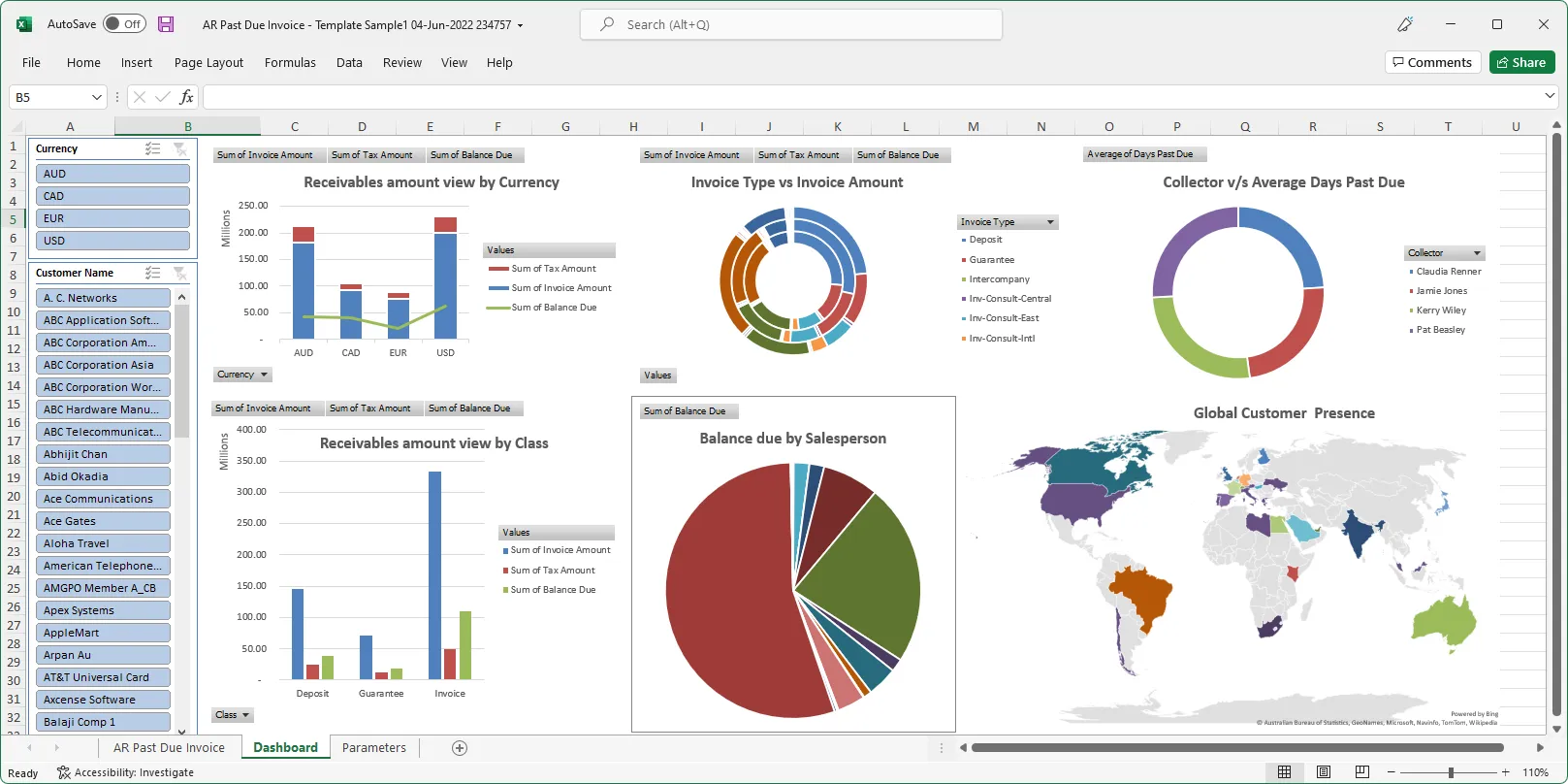

The Excel template upload functionality in Blitz Report allows users to create their own layouts by uploading an Excel template with additional sheets and charts, automatically refreshed when the report runs again. This allows to create custom dashboards and more advanced visualizations of report data.

You can download and use Blitz Report free of charge for your first 30 reports.

The installation and implementation process usually takes less than 1 hour; you can refer to our installation and user guides for specific details.

If you would like to optimize your Oracle EBS implementation and or operational reporting you can visit www.enginatics.com to review great ideas and example usage in blog. Or why not try for yourself in our demo environment.

Useful Links

Blitz Report™ – World’s fastest data upload and reporting for Oracle EBS

Oracle Discoverer replacement – importing worksheets into Blitz Report™

Blitz Report™ Questions & Answers

Supply Chain Hub by Blitz Report™

© 2025 Enginatics