PA Capital Project Summary with Asset Detail

Description:

Detail project report that shows the project asset details, and combined project level costs breakdown, along with the project assets details from the Capital Summary

Parameters

Project Type, Project Number, Operating Unit, Project Organization, Class Category, Class Code, Asset Trx Entered Period, Asset Date Effective Period, Asset Trx Entered Date From, Asset Trx Entered Date To, Asset Date Effective From, Asset Date Effective To, Include Unassigned Asset Lines, Unassigned Asset Line Type

Used tables

pa_projects_all, pa_project_statuses, pa_project_classes, hr_all_organization_units_vl, fa_locations_kfv, pa_project_assets_v, pa_capital_projects_v, pa_retirement_costs_v, fa_transaction_headers, fa_deprn_periods, pa_project_asset_lines_v, pa_asset_line_details_v

Categories

Related reports

GL Account Analysis (Distributions)

Dependencies

If you would like to try one of these Oracle EBS SQLs without having Blitz Report installed, note that some of the reports require functions from utility package xxen_util.

Example Report

PA Capital Project Summary with Asset Detail 10-Jul-2020 142116.xlsx

Report SQL

www.enginatics.com/reports/pa-capital-project-summary-with-asset-detail/

Blitz Report™ import options

PA_Capital_Project_Summary_with_Asset_Detail.xml

Case Study & Technical Analysis: PA Capital Project Summary with Asset Detail

Executive Summary

The PA Capital Project Summary with Asset Detail report is a comprehensive financial and operational tool for managing the entire lifecycle of capital projects in Oracle E-Business Suite. It provides a unified view that links the costs accumulated in a capital project with the detailed fixed asset lines generated from those costs. This report is essential for project accountants, fixed asset managers, and financial controllers to monitor project spending, manage the capitalization process, and ensure accurate reconciliation between Oracle Projects (PA) and Oracle Fixed Assets (FA).

Business Challenge

The process of accounting for capital projects—from accumulating construction-in-process (CIP) costs to placing the final assets in service—is one of the more complex processes in an ERP system. Key challenges include:

- Disconnected Modules: Data for a single capital project resides in two different modules. The costs are captured and tracked in Oracle Projects, while the final, depreciating assets are managed in Oracle Fixed Assets. There is a lack of standard reports that effectively bridge this gap.

- Difficult Reconciliation: Reconciling the CIP cost balance in Projects with the asset cost that has been interfaced to Fixed Assets is a critical but often difficult month-end task.

- Poor Visibility into Capitalization: It’s hard to get a clear, consolidated view of which project costs have been grouped into asset lines, which assets have been created, and what the status of the interface to the Fixed Assets module is.

- Managing Unassigned Costs: Identifying project costs that have not yet been assigned to a capital asset can be a manual and error-prone process, risking that costs are not capitalized in a timely manner.

The Solution

This report provides a complete, end-to-end view of a capital project’s financial lifecycle, from cost inception to asset capitalization.

- Unified Project and Asset View: It displays project-level cost breakdowns alongside a detailed listing of all the assets generated from that project, providing a single source of truth for all stakeholders.

- Streamlined Reconciliation: By showing both the project costs and the created asset lines, the report greatly simplifies the process of reconciling the PA subledger to the FA subledger for capital projects.

- Clear Asset Line Auditing: The report allows for a detailed review of all asset lines, both those that have been interfaced and those that are pending. The “Include Unassigned Asset Lines” parameter is a powerful feature for ensuring all eligible costs are capitalized.

- Improved Project Oversight: It provides project managers and financial analysts with a clear picture of how project expenditures are being converted into tangible company assets, improving financial control and project governance.

Technical Architecture (High Level)

The report is built on a query that joins data across the Oracle Projects and Oracle Fixed Assets schemas to provide its consolidated view.

- Primary Tables Involved:

pa_projects_all(for the basic project details).pa_capital_projects_v(a view summarizing capital project information).pa_project_assets_v(a view showing the assets defined within the project).pa_project_asset_lines_v(a view showing the detailed project cost distribution lines that have been assigned to each asset).fa_transaction_headers(to check the status of the asset interface transaction in Fixed Assets).

- Logical Relationships: The report starts with a capital project and uses the project ID to find the defined assets in

pa_project_assets_v. For each of these assets, it retrieves the detailed cost lines frompa_project_asset_lines_v. Finally, it checks for corresponding transactions in Fixed Assets to determine the capitalization and depreciation status.

Parameters & Filtering

The report’s parameters are designed to allow users to focus on specific projects or timeframes within the capital asset process:

- Project Selection: Users can select data for a specific

Project Type(e.g., Capital),Project Number, orProject Organization. - Date and Period Filtering: Multiple date and accounting period parameters (

Asset Trx Entered Period,Asset Date Effective Period, etc.) allow for precise, time-based analysis of capitalization activity. - Include Unassigned Asset Lines: A critical parameter for financial controllers, this allows the report to also show any project costs that have been flagged for capitalization but have not yet been grouped and assigned to a specific asset.

Performance & Optimization

The report queries across multiple modules and large data tables, and is optimized by its focused parameters.

- Project-Driven Query: The query is most efficient when a specific

Project Numberis provided, as this is the primary key that drives the selection of all other data. - Indexed Date Lookups: The use of specific accounting periods and date ranges for filtering asset transactions allows the database to use its indexes on the transaction tables for efficient data retrieval.

FAQ

1. What does an “unassigned asset line” represent? An unassigned asset line is a project cost (an expenditure item) that has been identified as capitalizable but has not yet been grouped together with other costs to form a specific, named asset (e.g., “Building A - Roof”). This report helps you find these “in-limbo” costs so they can be properly processed.

2. How can I tell if an asset from this report is already depreciating in Fixed Assets? The report typically includes status fields or information derived from the Fixed Assets module. Looking for a transaction status of ‘Posted’ in the FA transaction tables or seeing depreciation amounts would indicate that the asset is now active and depreciating in the FA subledger.

3. What is the difference between the ‘Asset Trx Entered Period’ and the ‘Asset Date Effective Period’? The ‘Asset Trx Entered Period’ usually refers to the accounting period in which the capitalization transaction was entered into the system. The ‘Asset Date Effective Period’ (often called the Date Placed in Service) is the accounting period in which the asset becomes active and depreciation begins. These can be different.

Oracle E-Business Suite Reporting Library

We provide an open source Oracle EBS SQLs as a part of operational and project implementation support toolkits for rapid Excel reports generation.

Blitz Report™ is based on Oracle EBS forms technology, and hence requires minimal training. There are no data or performance limitations since the output files are created directly from the database without going through intermediate file formats such as XML.

Blitz Report can be used as BI Publisher and Oracle Discoverer replacement tool. Standard Oracle BI Publisher and Discoverer reports can also be imported into Blitz Report for immediate output to Excel. Typically, reports can be created and version tracked within hours instead of days. The concurrent request output automatically opens upon completion without the need for re-formatting.

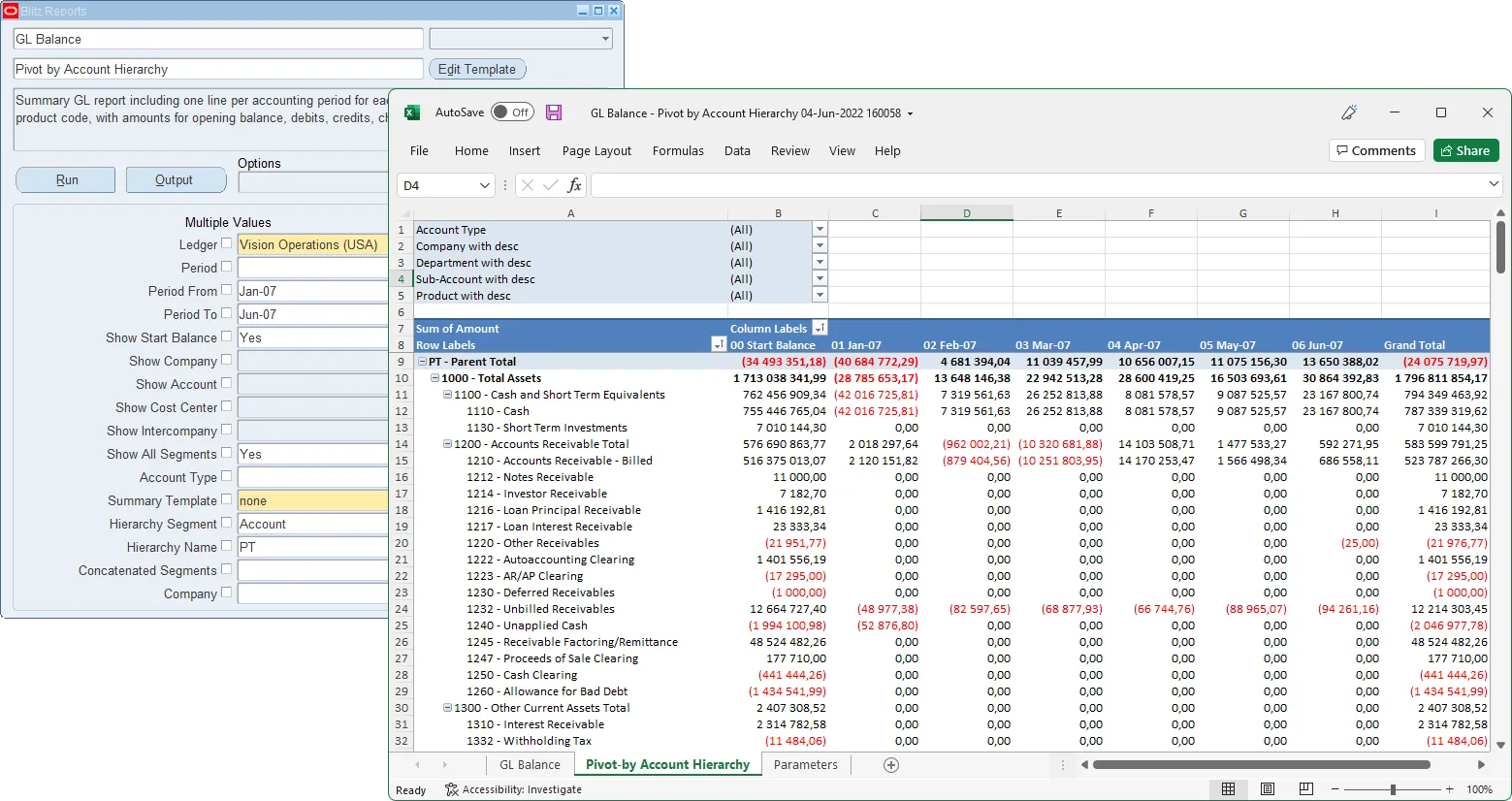

The Filters, Columns, Rows and Values fields are used to create and deliver the data in pivot table format with full drill down to details.

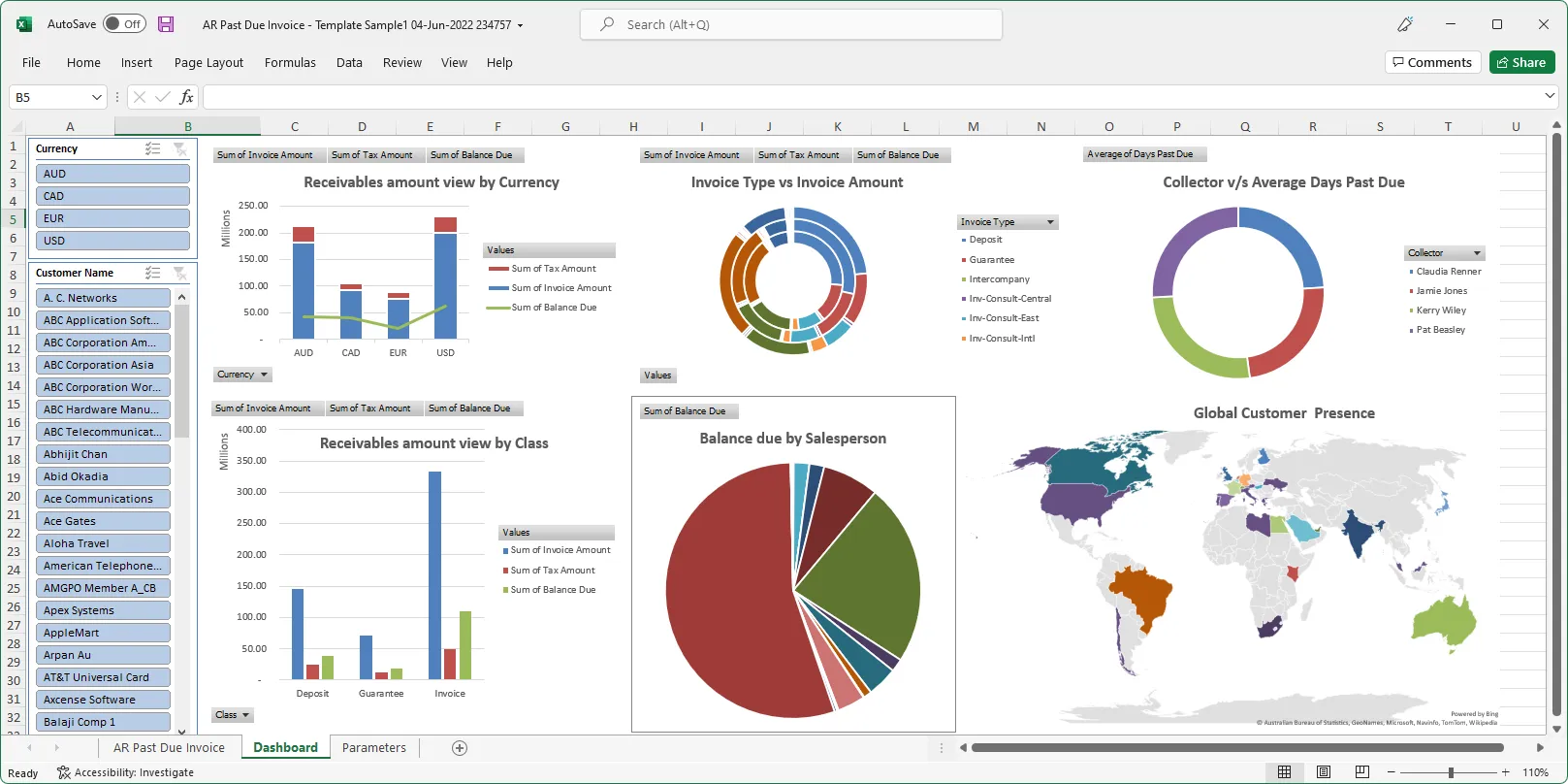

The Excel template upload functionality in Blitz Report allows users to create their own layouts by uploading an Excel template with additional sheets and charts, automatically refreshed when the report runs again. This allows to create custom dashboards and more advanced visualizations of report data.

You can download and use Blitz Report free of charge for your first 30 reports.

The installation and implementation process usually takes less than 1 hour; you can refer to our installation and user guides for specific details.

If you would like to optimize your Oracle EBS implementation and or operational reporting you can visit www.enginatics.com to review great ideas and example usage in blog. Or why not try for yourself in our demo environment.

Useful Links

Blitz Report™ – World’s fastest data upload and reporting for Oracle EBS

Oracle Discoverer replacement – importing worksheets into Blitz Report™

Blitz Report™ Questions & Answers

Supply Chain Hub by Blitz Report™

© 2025 Enginatics