ZX Financial Tax Register

Description:

Imported from Concurrent Program Description: Rx-only: Financial Tax Register Application: E-Business Tax Source: RX-only: Financial Tax Register Report Short Name: RXZXPTEX

Parameters

Reporting Level, Reporting Context, Company Name, Set of Books Currency, Register Type, Summary Level, Product, GL Date Low, GL Date High, Transaction Date Low, Transaction Date High, VAT Tax Transaction Type, Tax Type Low, Tax Type High, Tax Regime Code, Tax, Tax Jurisdiction, Tax Status Code, Tax Code Low, Tax Code High, Currency Code Low, Currency Code High, Transfer to GL, Accounting Status, AR Exemption Status, Transaction Number, Include Standard Invoices, Include Debit Memos, Include Credit Memos, Include Prepayments, Include Mixed Invoices, Include Expense Reports, Include Invoices, Include Applications, Include Adjustments, Include Miscellaneous receipts, Include Bills Receivables, Include Accounting Segments, Include Discounts, Include Referenced Source

Used tables

Categories

Dependencies

If you would like to try one of these Oracle EBS SQLs without having Blitz Report installed, note that some of the reports require functions from utility package xxen_util.

Example Report

ZX Financial Tax Register - Tax Register 06-Aug-2024 034931.xlsx

Report SQL

www.enginatics.com/reports/zx-financial-tax-register/

Blitz Report™ import options

ZX Financial Tax Register - Case Study & Technical Analysis

Executive Summary

The ZX Financial Tax Register is a critical compliance and audit tool within the Oracle E-Business Tax (EB-Tax) module. It serves as the primary source of truth for all tax-related transactions across the enterprise, consolidating data from Payables (AP), Receivables (AR), and the General Ledger (GL). This report is essential for preparing VAT/GST returns, US Sales Tax reports, and supporting tax audits with detailed transaction lineage.

Business Challenge

Tax departments face significant hurdles in:

- Reconciliation: reconciling tax amounts reported to authorities with the General Ledger balances.

- Data Fragmentation: Tax data is often scattered across multiple subledgers (AP Invoices, AR Transactions, GL Journals).

- Audit Defense: Providing a complete, transaction-level audit trail for every tax line item calculated or recovered.

- Complex Regimes: Managing reporting for multiple tax regimes and jurisdictions within a single global instance.

Solution

This report provides a unified, high-fidelity view of the tax repository. It enables tax professionals to:

- Centralize Reporting: Access a single register for all tax transactions, regardless of the source application.

- Verify Accounting: Check the

Accounting StatusandTransfer to GLflags to ensure all tax lines are properly accounted. - Analyze by Regime: Filter data by Tax Regime, Tax, Status, and Jurisdiction for targeted analysis.

- Drill to Source: Link tax lines back to the original transaction (Invoice, Credit Memo, Journal) for full auditability.

Technical Architecture

The report is built upon the E-Business Tax repository, specifically leveraging the standard extract views provided by Oracle to ensure consistency with standard concurrent programs.

Key Tables & Views

| Table Name | Description |

| :— | :— |

| ZX_REP_EXTRACT_V | The primary view used by the standard “Financial Tax Register”. It consolidates data from ZX_LINES and related transaction tables. |

| ZX_LINES | The core table storing tax lines for all transactions. |

| ZX_RATES_B | Definitions of tax rates and codes. |

| ZX_REGIMES_B | Definitions of tax regimes (e.g., VAT, SALES_TAX). |

| GL_CODE_COMBINATIONS | Used to display the tax liability and recovery account details. |

Core Logic

- Data Extraction: The report relies on

ZX_REP_EXTRACT_V, which pre-joins the complex tax model (Regimes, Taxes, Statuses, Rates) with the transaction details. - Filtering: Extensive parameters allow filtering by Date Range (GL or Transaction), Tax Regime, Tax Type, and Transaction Type.

- Subledger Integration: The view abstracts the complexity of linking back to

AP_INVOICES_ALL,RA_CUSTOMER_TRX_ALL, etc., providing a consistent “Transaction Number” and “Transaction Date” regardless of source.

FAQ

Q: Is this the same as the standard Oracle “Financial Tax Register”?

A: Yes, this SQL is designed to replicate the output of the standard RXZXPTEX concurrent program but in a direct-to-Excel format.

Q: Can I use this for both Input (AP) and Output (AR) tax? A: Yes, the register covers both Input Tax (Payables) and Output Tax (Receivables).

Q: Does it show tax that hasn’t been accounted yet?

A: Yes, the Accounting Status parameter allows you to view Posted, Unposted, or All transactions.

Q: How does it handle partial payments for Cash Basis tax reporting?

A: The underlying view ZX_REP_EXTRACT_V contains logic to handle tax reporting based on the tax point basis (Invoice vs. Payment), which is critical for Cash Basis regimes.

Oracle E-Business Suite Reporting Library

We provide an open source Oracle EBS SQLs as a part of operational and project implementation support toolkits for rapid Excel reports generation.

Blitz Report™ is based on Oracle EBS forms technology, and hence requires minimal training. There are no data or performance limitations since the output files are created directly from the database without going through intermediate file formats such as XML.

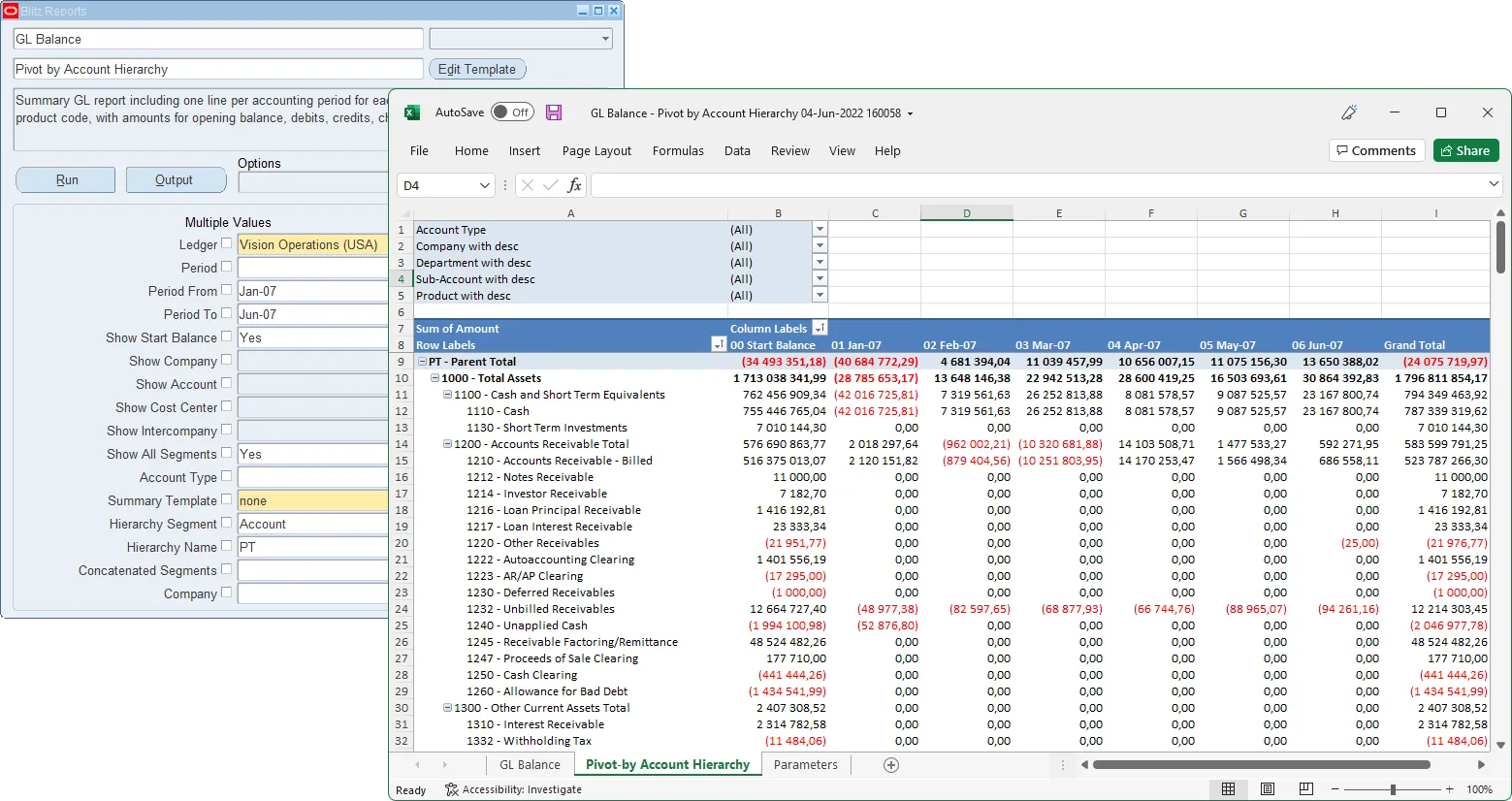

Blitz Report can be used as BI Publisher and Oracle Discoverer replacement tool. Standard Oracle BI Publisher and Discoverer reports can also be imported into Blitz Report for immediate output to Excel. Typically, reports can be created and version tracked within hours instead of days. The concurrent request output automatically opens upon completion without the need for re-formatting.

The Filters, Columns, Rows and Values fields are used to create and deliver the data in pivot table format with full drill down to details.

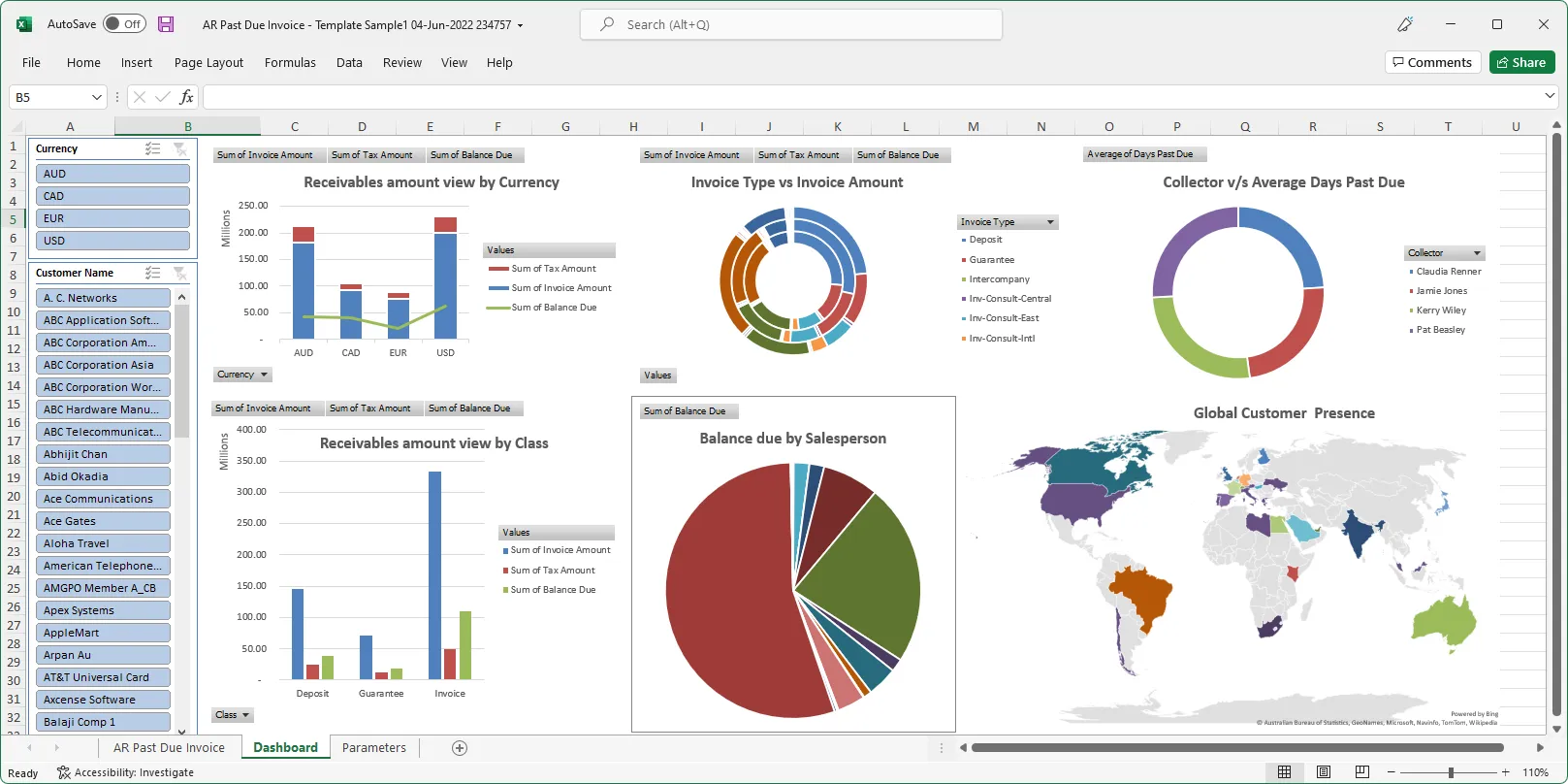

The Excel template upload functionality in Blitz Report allows users to create their own layouts by uploading an Excel template with additional sheets and charts, automatically refreshed when the report runs again. This allows to create custom dashboards and more advanced visualizations of report data.

You can download and use Blitz Report free of charge for your first 30 reports.

The installation and implementation process usually takes less than 1 hour; you can refer to our installation and user guides for specific details.

If you would like to optimize your Oracle EBS implementation and or operational reporting you can visit www.enginatics.com to review great ideas and example usage in blog. Or why not try for yourself in our demo environment.

Useful Links

Blitz Report™ – World’s fastest data upload and reporting for Oracle EBS

Oracle Discoverer replacement – importing worksheets into Blitz Report™

Blitz Report™ Questions & Answers

Supply Chain Hub by Blitz Report™

© 2025 Enginatics