ZX Lines Summary

Description:

Tax lines summary to understand the different applications, entity codes and events that generate tax lines

Parameters

Used tables

Categories

Dependencies

If you would like to try one of these Oracle EBS SQLs without having Blitz Report installed, note that some of the reports require functions from utility package xxen_util.

Example Report

ZX Lines Summary 27-May-2021 165955.xlsx

Report SQL

www.enginatics.com/reports/zx-lines-summary/

Blitz Report™ import options

Case Study & Technical Analysis: ZX Lines Summary Report

Executive Summary

The ZX Lines Summary report is a crucial tax audit and analysis tool for Oracle E-Business Tax (EBTax). It provides a summarized overview of tax lines generated across various applications, entity codes, and events within Oracle E-Business Suite. This report is indispensable for tax accountants, financial analysts, and system administrators to understand the complex origination of tax amounts, reconcile tax data between subledgers and the General Ledger, troubleshoot tax calculation issues, and ensure compliance with global tax regulations.

Business Challenge

Oracle E-Business Tax is a sophisticated engine that calculates taxes for transactions across almost all modules (e.g., Payables, Receivables, Order Management). Understanding how these tax lines are generated and ensuring their accuracy is a significant challenge:

- Opaque Tax Calculation: It’s often difficult to trace a specific tax amount on an invoice or sales order back to its calculation source, understanding which

application,entity_code, andevent_typetriggered its creation. - Tax Reconciliation Complexities: Reconciling reported tax amounts in the GL with the detailed tax lines in EBTax (ZX_LINES) is a critical month-end task, often plagued by discrepancies that are challenging to isolate.

- Troubleshooting Tax Errors: When tax is incorrectly calculated or posted, diagnosing the issue requires precise information on the attributes of the tax line, its originating transaction, and the EBTax setup that generated it.

- Cross-Application Visibility: Tax lines can originate from many different applications. Getting a consolidated summary across all modules helps identify common issues or patterns in tax generation that might otherwise be missed.

- Audit and Compliance: For tax audits and regulatory compliance, a clear, auditable record of how tax lines are generated and their associated transaction details is mandatory.

The Solution

This report offers a powerful, summarized, and transparent solution for analyzing tax lines, bringing clarity to Oracle E-Business Tax processes.

- Consolidated Tax Line Overview: It provides a summarized view of

ZX_LINES, detailing the differentapplications(e.g., Payables, Receivables),entity codes(e.g., Invoice, Payment), andevent typesthat generate tax amounts. This offers a holistic understanding of tax origination. - Streamlined Tax Reconciliation: By showing the aggregated values of tax lines by their source, the report assists tax accountants in reconciling tax subledger data with the General Ledger and external tax reporting, helping to quickly identify variances.

- Accelerated Troubleshooting: When a tax calculation issue arises, this report provides immediate insight into the originating application and event, helping to quickly pinpoint where the tax line was created and why it might be incorrect.

- Enhanced Compliance: The report serves as a valuable audit tool, providing documentation of the sources and types of tax lines generated across the system, which is crucial for demonstrating compliance with tax regulations.

Technical Architecture (High Level)

The report queries core Oracle E-Business Tax (ZX) and FND tables to summarize tax line information.

- Primary Tables Involved:

zx_lines(the central table for all tax lines generated by EBTax, storing amounts, tax codes, source application details, etc.).fnd_application_vl(for application names, providing context).

- Logical Relationships: The report aggregates and summarizes records from

zx_lines. It groups tax lines byapplication_id,entity_code, andevent_type(which are foreign keys withinzx_linesthat link back to the originating subledger transaction and event). A join tofnd_application_vltranslates theapplication_idinto a user-friendly application name (e.g., ‘Payables’, ‘Receivables’), providing clear context for each set of tax lines.

Parameters & Filtering

No Explicit Parameters: The README.md indicates no specific parameters for this report. This implies that, by design, it provides a comprehensive summary of all tax lines across the system. This is advantageous for a full, unfiltered audit of tax line generation, allowing users to apply external filtering in Excel after export.

Performance & Optimization

As a summary report querying potentially large transactional tax tables, it is optimized by efficient aggregation.

- Efficient Aggregation: The report performs efficient

SUMandCOUNTaggregations on thezx_linestable. By summarizing data rather than returning every individual tax line, it handles large volumes of data quickly. - Indexed Columns: The

zx_linestable is typically indexed onapplication_id,entity_code,event_type, andcreation_date, which allows for efficient grouping and retrieval of summarized data.

FAQ

1. What is a ‘Tax Line’ in Oracle E-Business Tax?

A ‘Tax Line’ is a record in the ZX_LINES table that represents a specific tax amount calculated for a transaction in Oracle E-Business Suite. Each tax line details the tax amount, tax rate, tax code, and importantly, links back to the originating transaction (e.g., an invoice line, a sales order line) and the application that created it.

2. How does this report help reconcile tax amounts in the GL? By showing the summary of tax lines by application and event, this report allows tax accountants to compare these aggregated tax amounts with the corresponding tax balances in the General Ledger. If there are discrepancies, the report helps to quickly identify which subledger or type of transaction is the source of the issue, enabling further, detailed investigation.

3. Can this report identify if tax was not calculated when it should have been? This report primarily focuses on tax lines that were generated. To identify transactions where tax should have been calculated but wasn’t, you would typically need a different type of report that reviews source transactions (e.g., AP invoice lines, OM order lines) and checks for missing tax allocations, or uses a custom query to compare expected tax with actual generated tax lines.

Oracle E-Business Suite Reporting Library

We provide an open source Oracle EBS SQLs as a part of operational and project implementation support toolkits for rapid Excel reports generation.

Blitz Report™ is based on Oracle EBS forms technology, and hence requires minimal training. There are no data or performance limitations since the output files are created directly from the database without going through intermediate file formats such as XML.

Blitz Report can be used as BI Publisher and Oracle Discoverer replacement tool. Standard Oracle BI Publisher and Discoverer reports can also be imported into Blitz Report for immediate output to Excel. Typically, reports can be created and version tracked within hours instead of days. The concurrent request output automatically opens upon completion without the need for re-formatting.

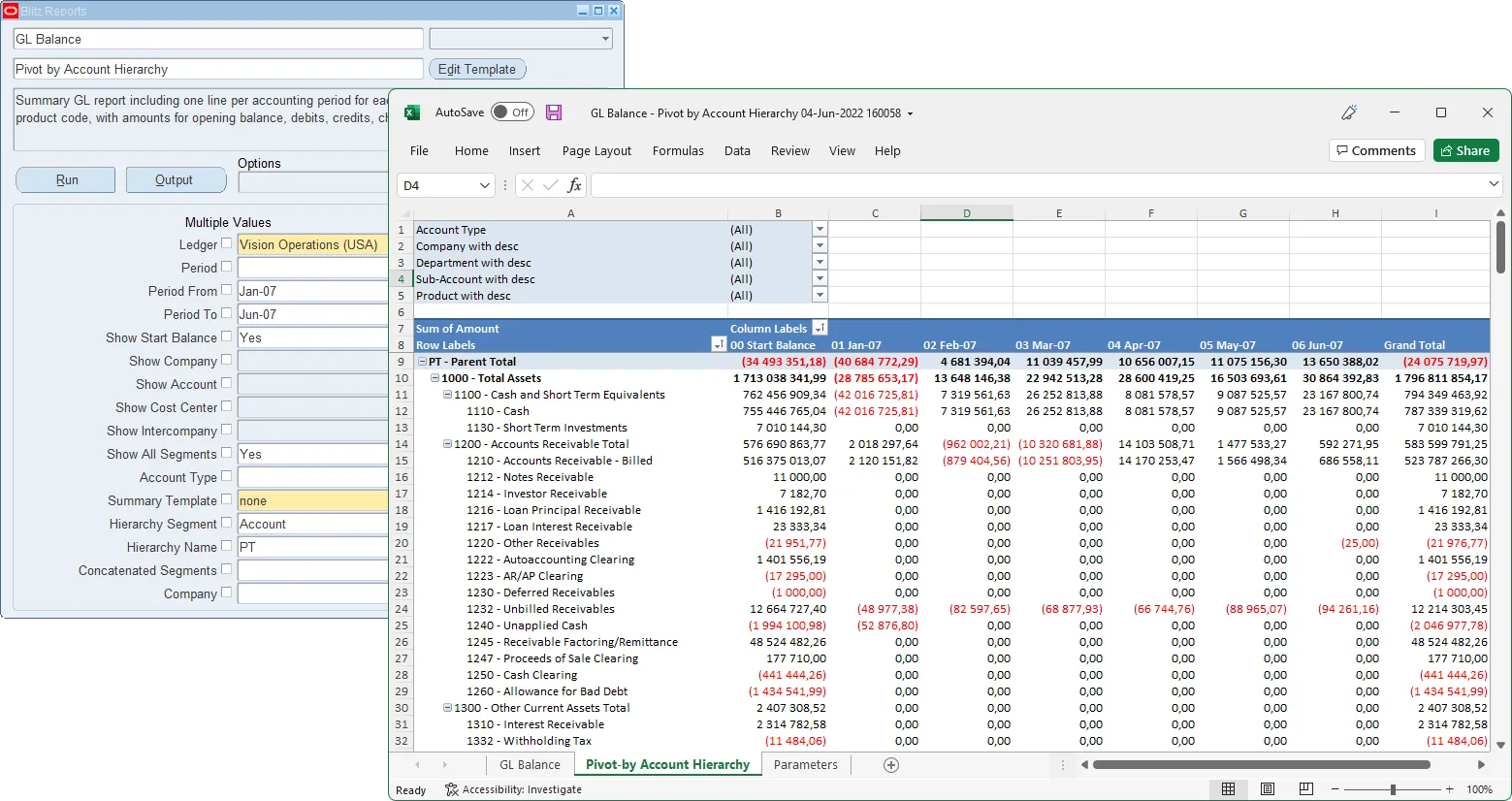

The Filters, Columns, Rows and Values fields are used to create and deliver the data in pivot table format with full drill down to details.

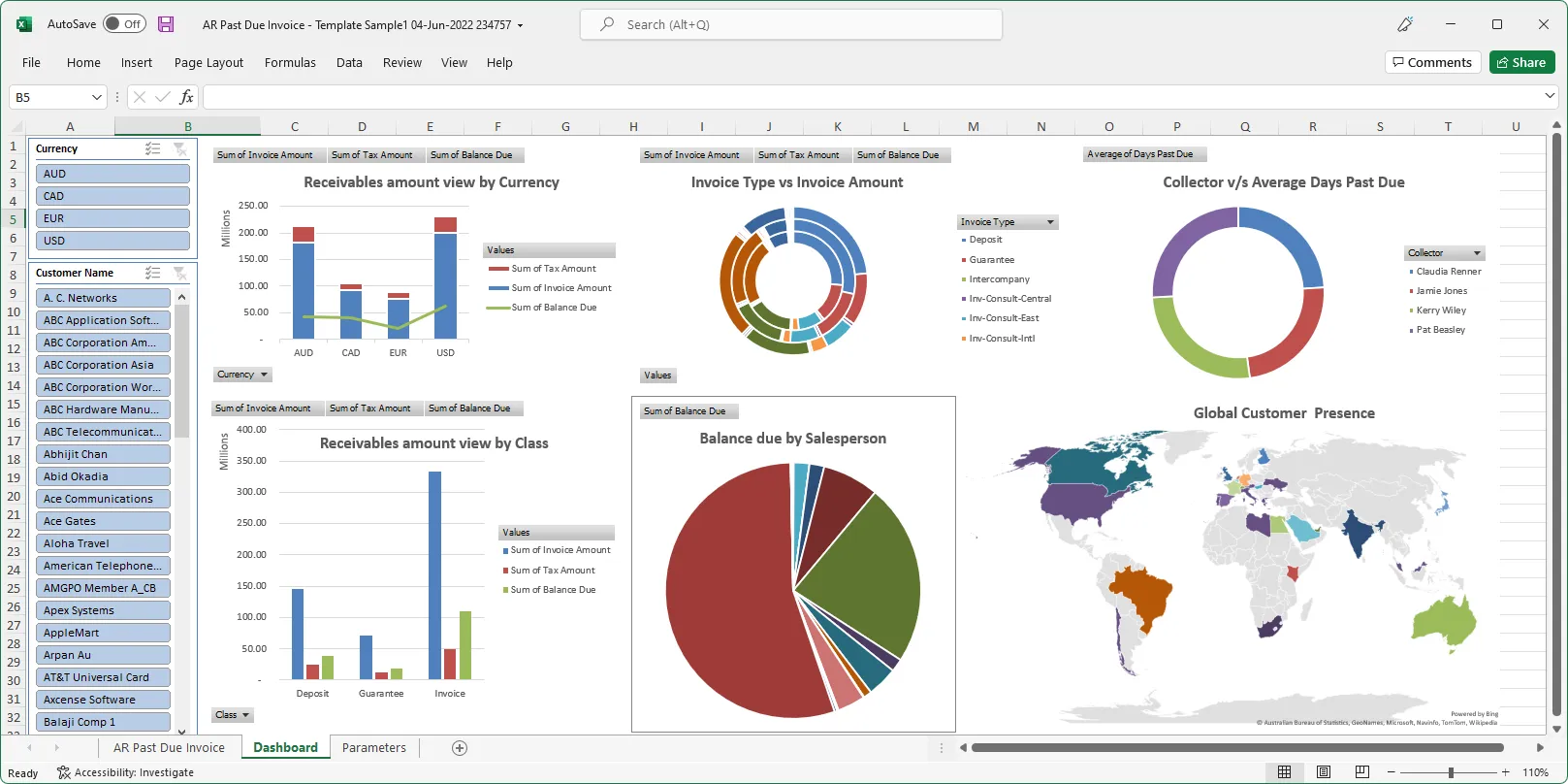

The Excel template upload functionality in Blitz Report allows users to create their own layouts by uploading an Excel template with additional sheets and charts, automatically refreshed when the report runs again. This allows to create custom dashboards and more advanced visualizations of report data.

You can download and use Blitz Report free of charge for your first 30 reports.

The installation and implementation process usually takes less than 1 hour; you can refer to our installation and user guides for specific details.

If you would like to optimize your Oracle EBS implementation and or operational reporting you can visit www.enginatics.com to review great ideas and example usage in blog. Or why not try for yourself in our demo environment.

Useful Links

Blitz Report™ – World’s fastest data upload and reporting for Oracle EBS

Oracle Discoverer replacement – importing worksheets into Blitz Report™

Blitz Report™ Questions & Answers

Supply Chain Hub by Blitz Report™

© 2025 Enginatics