ZX Tax Regimes

Description:

E-Business Tax tax regime and party subscription setup

Parameters

Tax Regime Code, Show Regime Subscriptions, Country

Used tables

gl_daily_conversion_types, zx_party_tax_profile, hz_parties, zx_regimes_vl, fnd_territories_vl, zx_regimes_usages, zx_first_party_orgs_all_v, zx_subscription_options

Categories

Related reports

Dependencies

If you would like to try one of these Oracle EBS SQLs without having Blitz Report installed, note that some of the reports require functions from utility package xxen_util.

Example Report

ZX Tax Regimes 27-May-2021 194742.xlsx

Report SQL

www.enginatics.com/reports/zx-tax-regimes/

Blitz Report™ import options

Case Study & Technical Analysis: ZX Tax Regimes Report

Executive Summary

The ZX Tax Regimes report is a crucial tax configuration and audit tool for Oracle E-Business Tax (EBTax). It provides a comprehensive listing of all defined tax regimes and, critically, their associated party subscriptions. A tax regime is a set of tax rules that governs transactions for a particular tax (e.g., VAT, Sales Tax) within a specific geography. This report is indispensable for tax accountants, financial analysts, and system administrators to understand the complex global tax structures, ensure compliance with various tax laws, audit party tax subscriptions, and maintain a robust and accurate tax determination framework across the enterprise.

Business Challenge

For multi-national organizations, managing tax determination across various countries and tax types is one of the most complex aspects of financial operations. Oracle EBTax provides a powerful framework, but understanding its foundational setup can be challenging:

- Global Tax Complexity: Different countries have different tax requirements (e.g., VAT, GST, Sales Tax, Income Tax), each governed by its own set of rules and regulations (tax regimes). Managing these diverse regimes and ensuring their correct configuration is a significant challenge.

- Ensuring Compliance: Non-compliance with tax laws, even due to minor configuration errors, can lead to substantial financial penalties, legal issues, and reputational damage. A consolidated view of tax regime setups is essential for auditing compliance.

- Opaque Party Subscriptions: For a legal entity or operating unit to participate in a tax regime, it must be “subscribed” to it. Understanding these party subscriptions is crucial for accurate tax determination but is often difficult to visualize and audit effectively.

- Troubleshooting Tax Issues: When tax is incorrectly calculated on a transaction, the issue can often be traced back to an incorrect tax regime setup or a missing/incorrect party subscription. Diagnosing these problems requires precise information on the active regimes and their linkages.

- Audit and Documentation: Maintaining accurate documentation of all tax regimes, their applicability, and party subscriptions is mandatory for internal and external tax audits.

The Solution

This report offers a powerful, consolidated, and transparent solution for analyzing tax regime configurations and party subscriptions, bringing clarity and control to global tax determination.

- Comprehensive Tax Regime Overview: It presents a detailed list of all

Tax Regimes, including theirTax Regime Code, name, description, and theCountrythey apply to. This provides a holistic view of the global tax landscape. - Visibility into Party Subscriptions: The

Show Regime Subscriptionsparameter is a crucial feature, allowing users to explicitly see which legal entities or operating units are subscribed to each tax regime, along with their associated tax profiles. This demystifies the tax applicability for different internal parties. - Streamlined Configuration Audit: Tax accountants and auditors can use this report to quickly review and verify tax regime setups and party subscriptions, ensuring they are correctly defined and align with financial policies and tax requirements across various jurisdictions.

- Accelerated Troubleshooting: When a tax determination issue arises, this report provides immediate insight into the active tax regimes and party subscriptions, helping to quickly pinpoint and resolve misconfigurations.

Technical Architecture (High Level)

The report queries core Oracle E-Business Tax (ZX), Trading Community Architecture (HZ), Legal Entity Configurator (XLE), and FND tables to assemble comprehensive tax regime and subscription data.

- Primary Tables Involved:

zx_regimes_vl(the central view for tax regime definitions).zx_regimes_usages(links regimes to various first-party organizations).zx_party_tax_profile(for party tax profiles, indicating subscription to regimes).hz_parties(for core party information).fnd_territories_vl(for country names).zx_first_party_orgs_all_vandzx_subscription_options(for more detailed subscription information).

- Logical Relationships: The report selects tax regimes from

zx_regimes_vl. WhenShow Regime Subscriptionsis enabled, it performs joins tozx_regimes_usagesorzx_party_tax_profile(and subsequently tohz_parties,xle_entity_profiles,hr_all_organization_units_vl) to identify which legal entities or operating units are subscribed to each regime. This comprehensive linkage provides a full picture of the tax setup for each internal party within specific tax jurisdictions.

Parameters & Filtering

The report offers flexible parameters for targeted analysis of tax regimes and subscriptions:

- Tax Regime Code: Allows users to focus on a specific tax regime for detailed review.

- Show Regime Subscriptions: A crucial parameter that, when set to ‘Yes’, expands the report to include all legal entities and operating units that are subscribed to the displayed tax regimes.

- Country: Filters by the country to which the tax regime applies, useful for regional tax compliance checks.

Performance & Optimization

As a configuration report integrating data across multiple modules, it is optimized by efficient filtering and conditional data loading.

- Parameter-Driven Efficiency: The

Tax Regime CodeandCountryparameters are critical for performance, allowing the database to efficiently narrow down the set of tax regimes and their associated subscriptions to process, leveraging existing indexes. - Conditional Subscription Loading: The

Show Regime Subscriptionsparameter is crucial. The potentially more complex joins to party and subscription tables are only executed when this detailed information is explicitly requested, preventing unnecessary database load for simpler regime overviews.

FAQ

1. What is a ‘Tax Regime’ in Oracle EBTax?

A ‘Tax Regime’ is the highest-level grouping of tax rules that applies to a particular tax within a specific country or geographical region. For example, a single Tax Regime might be defined for “US Sales Tax” or “EU VAT.” It defines the overall framework, including tax calculation rules, reporting requirements, and compliance obligations for that tax.

2. Why is ‘Party Subscription’ to a tax regime important? A ‘Party Subscription’ is the process of explicitly associating a legal entity or operating unit with a particular tax regime. This subscription signals to the EBTax engine that this specific internal organization is subject to the rules of that tax regime, enabling accurate tax determination on its transactions.

3. Can this report help identify legal entities that are not subscribed to a required tax regime?

Yes. By using the Show Regime Subscriptions parameter and reviewing the output for a specific Tax Regime Code, tax administrators can identify if any expected legal entities or operating units are missing from the subscription list. This flags potential compliance gaps where an entity might be conducting business in a jurisdiction but is not properly configured for its tax obligations.

Oracle E-Business Suite Reporting Library

We provide an open source Oracle EBS SQLs as a part of operational and project implementation support toolkits for rapid Excel reports generation.

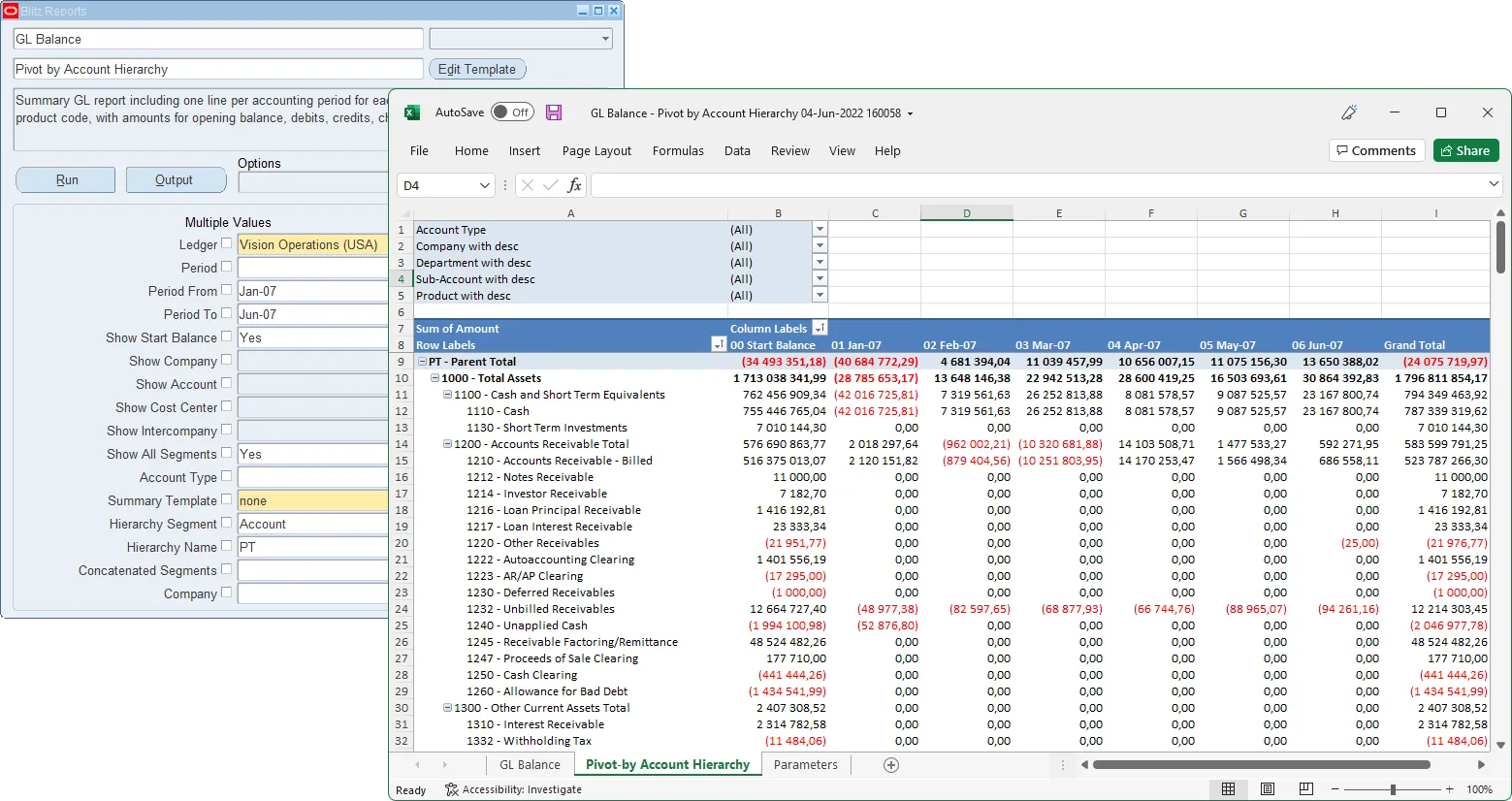

Blitz Report™ is based on Oracle EBS forms technology, and hence requires minimal training. There are no data or performance limitations since the output files are created directly from the database without going through intermediate file formats such as XML.

Blitz Report can be used as BI Publisher and Oracle Discoverer replacement tool. Standard Oracle BI Publisher and Discoverer reports can also be imported into Blitz Report for immediate output to Excel. Typically, reports can be created and version tracked within hours instead of days. The concurrent request output automatically opens upon completion without the need for re-formatting.

The Filters, Columns, Rows and Values fields are used to create and deliver the data in pivot table format with full drill down to details.

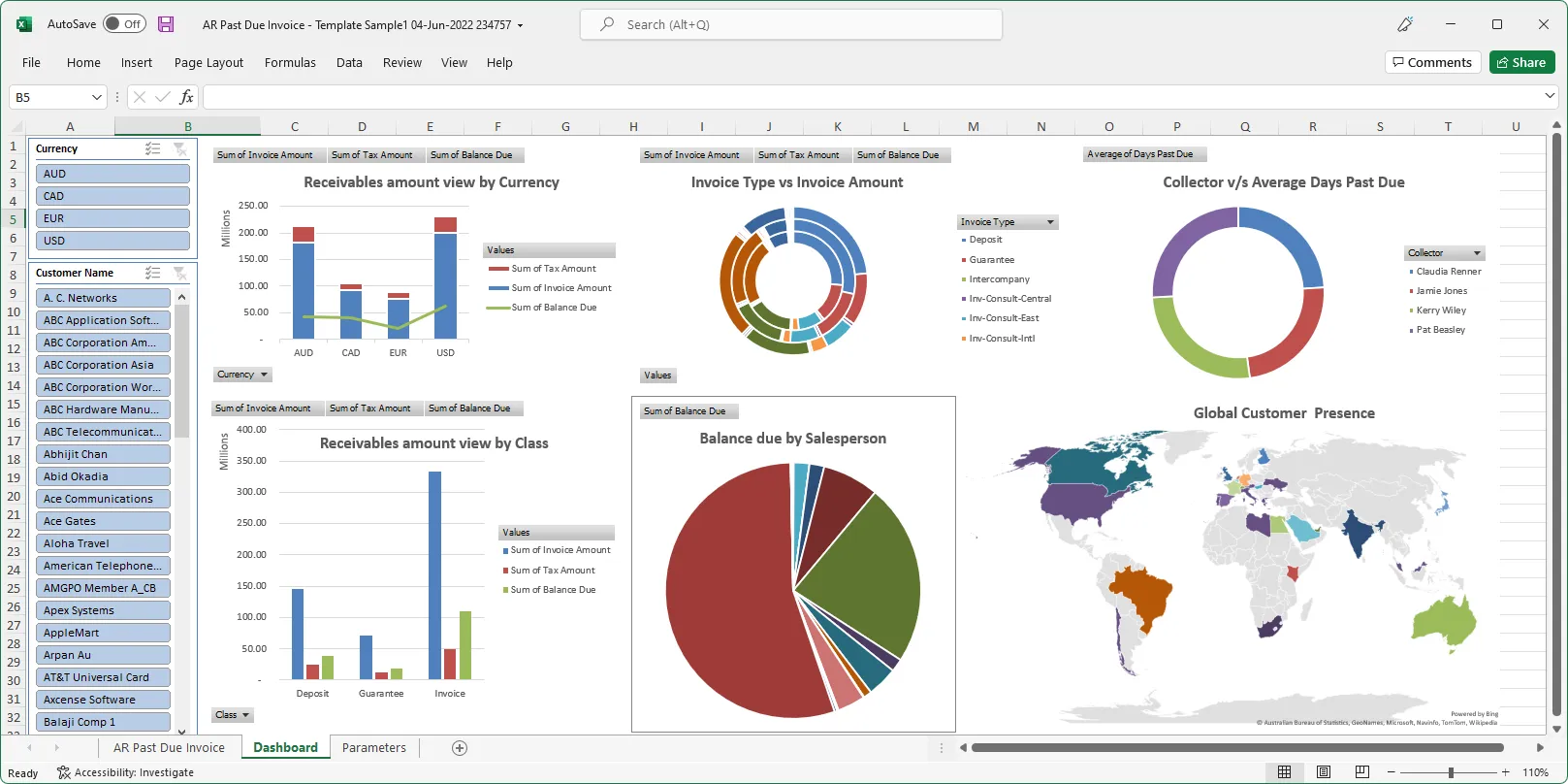

The Excel template upload functionality in Blitz Report allows users to create their own layouts by uploading an Excel template with additional sheets and charts, automatically refreshed when the report runs again. This allows to create custom dashboards and more advanced visualizations of report data.

You can download and use Blitz Report free of charge for your first 30 reports.

The installation and implementation process usually takes less than 1 hour; you can refer to our installation and user guides for specific details.

If you would like to optimize your Oracle EBS implementation and or operational reporting you can visit www.enginatics.com to review great ideas and example usage in blog. Or why not try for yourself in our demo environment.

Useful Links

Blitz Report™ – World’s fastest data upload and reporting for Oracle EBS

Oracle Discoverer replacement – importing worksheets into Blitz Report™

Blitz Report™ Questions & Answers

Supply Chain Hub by Blitz Report™

© 2025 Enginatics