ZX US Sales Tax

Description:

Imported from Concurrent Program Description: Sales Tax Report for use in U.S Application: E-Business Tax Source: U.S. Sales Tax Report Short Name: ZXXSTR

Parameters

Reporting Level, Reporting Context, Transaction Number, Transaction Date Low, Transaction Date High, GL Date Low, GL Date High, State Low, State High, Currency Low, Currency High, Exemption Status, Sales Tax Liability Account From, Sales Tax Liability Account To, Transfer to GL, Show all Adjustments & Credits, Include Non Tax Transactions, Debug Mode

Used tables

ra_customer_trx_all, zx_lines_det_factors, ra_cust_trx_line_gl_dist_all, ra_cust_trx_types_all, hz_cust_site_uses_all, hz_cust_acct_sites_all, hz_party_sites, hz_locations, hz_loc_assignments_obs, fnd_currencies, hz_cust_accounts, hz_parties, zx_rates_vl, &lp_table_parent_deposit_type, ra_customer_trx_lines_all, gl_code_combinations_kfv, zx_taxes_b

Categories

Dependencies

If you would like to try one of these Oracle EBS SQLs without having Blitz Report installed, note that some of the reports require functions from utility package xxen_util.

Example Report

Report SQL

www.enginatics.com/reports/zx-us-sales-tax/

Blitz Report™ import options

Case Study & Technical Analysis: ZX US Sales Tax Report

Executive Summary

The ZX US Sales Tax report is a crucial tax compliance and audit tool for organizations operating in the United States and utilizing Oracle E-Business Tax (EBTax). It provides a detailed breakdown of sales tax transactions, helping businesses manage their state-specific sales tax liabilities, reconcile collected tax amounts, and ensure accurate reporting to US tax authorities. This report is indispensable for tax accountants, financial analysts, and system administrators to understand the complex origination of sales tax, identify taxable and exempt transactions, troubleshoot tax calculation issues, and maintain a robust and compliant US sales tax framework.

Business Challenge

US Sales Tax is a highly complex area, with rules varying significantly by state, county, and even city, as well as by item and customer taxability. Managing this complexity presents significant challenges:

- Multi-Jurisdictional Compliance: Organizations operating across multiple US states face the daunting task of ensuring correct sales tax calculation and reporting for each relevant jurisdiction, a task prone to error with manual processes.

- Reconciling Sales Tax Liabilities: Reconciling collected sales tax amounts from customer invoices (Accounts Receivable) with the sales tax liability accounts in the General Ledger is a critical and often complex month-end task.

- Identifying Exempt Transactions: Accurately identifying and reporting sales that were exempt from tax (e.g., resale, government purchases) is essential for compliance but requires clear visibility into transaction attributes.

- Troubleshooting Tax Calculation Errors: When sales tax is incorrectly calculated on a sales order or invoice, diagnosing the issue requires precise information on the transaction details, customer taxability, and EBTax setup that generated the tax line.

- Audit Readiness: For state sales tax audits, providing detailed transaction-level data, including taxability and exemption status, is a mandatory requirement that necessitates robust reporting capabilities.

The Solution

This report offers a powerful, configurable, and transparent solution for analyzing US Sales Tax transactions, bringing clarity and control to sales tax compliance and reporting.

- Detailed Sales Tax Breakdown: It provides a granular listing of sales tax lines, including transaction details (e.g.,

Transaction Number,Transaction Date),Stateinformation,Currency,Exemption Status, and theSales Tax Liability Accountaffected. This offers a holistic view of sales tax activity. - Flexible Reporting Levels and Context: Parameters like

Reporting LevelandReporting Contextallow users to focus on specific legal entities or operating units for targeted tax analysis. - Reconciliation Support: By detailing tax lines and their GL distributions, the report assists tax accountants in reconciling sales tax collected (from AR) to the corresponding sales tax liability accounts in the GL.

- Visibility into Exemptions and Adjustments: Parameters to

Show all Adjustments & CreditsandInclude Non Tax Transactions(for complete transaction context) provide crucial insight into the various factors influencing net sales tax liability. - Debug Mode for Troubleshooting: The

Debug Modeparameter is an invaluable feature for technical analysts, providing additional diagnostic information to troubleshoot complex tax calculation issues.

Technical Architecture (High Level)

The report queries core Oracle Receivables (AR) and E-Business Tax (ZX) tables to provide its detailed sales tax analysis. It is an enhanced version of a standard Oracle concurrent program.

- Primary Tables Involved:

ra_customer_trx_allandra_customer_trx_lines_all(for sales invoice headers and lines).zx_lines_det_factors(the central table for EBTax line details, linking to specific tax rates and determined factors).ra_cust_trx_line_gl_dist_all(for GL account distributions of AR transactions).hz_cust_accounts,hz_parties,hz_cust_site_uses_all,hz_locations(for customer and bill-to/ship-to location details).gl_code_combinations_kfv(for GL sales tax liability account details).zx_rates_vlandzx_taxes_b(for tax rate and tax definitions).

- Logical Relationships: The report links

ra_customer_trx_allandra_customer_trx_lines_alltozx_lines_det_factorsto retrieve all sales tax lines associated with customer transactions. It then joins to customer master, geographical, and GL tables to provide rich contextual information, including theState(jurisdiction),Sales Tax Liability Account, and various transaction details, all filtered by the user’s specified criteria.

Parameters & Filtering

The report offers an extensive set of parameters for precise filtering and detailed data inclusion:

- Reporting Context:

Reporting LevelandReporting Context(e.g., Legal Entity, Operating Unit) define the organizational scope for tax reporting. - Transaction Identification:

Transaction Numberallows for precise targeting of specific invoices.Transaction Date Low/HighandGL Date Low/Highare crucial for defining the reporting period. - Geographical Filters:

State Low/Highallows for focusing on specific US states for sales tax analysis. - Financial Filters:

Currency Low/Highfilters by currency.Sales Tax Liability Account From/Toallows for filtering by specific GL accounts. - Inclusion Flags:

Exemption Status(to show taxable vs. exempt),Transfer to GL(to see what has been posted),Show all Adjustments & Credits, andInclude Non Tax Transactionsprovide comprehensive control over the report’s content. - Debug Mode:

Debug Modeis a technical parameter for detailed troubleshooting.

Performance & Optimization

As a detailed transactional report integrating data across multiple modules (AR, EBTax, GL), it is optimized through strong filtering and date-driven processing.

- Date and State-Driven Filtering: The

Transaction Date Low/High,GL Date Low/High, andState Low/Highparameters are critical for performance, allowing the database to efficiently narrow down the large volumes of AR and EBTax transaction data to the relevant timeframe and geographical scope using existing indexes. - Targeted Data Retrieval: The report’s SQL is specifically designed to retrieve sales tax lines and their associated details efficiently, avoiding full table scans of all transactional data.

- Conditional Data Inclusion: Parameters like

Include Non Tax TransactionsorShow all Adjustments & Creditsallow the report to execute more complex joins or data retrieval only when that specific detail is requested, preventing unnecessary database load.

FAQ

1. What is the primary difference between a ‘Transaction Date’ and a ‘GL Date’ in this report?

The Transaction Date is the actual date the customer invoice or sales order was created. The GL Date is the accounting period date when the transaction’s financial impact (including sales tax) is recognized in the General Ledger. These dates can differ, especially if transactions are created in one period but accounted for in another.

2. How does the report identify ‘Sales Tax Liability Accounts’?

The report links the sales tax lines (zx_lines_det_factors) to their corresponding GL distributions (ra_cust_trx_line_gl_dist_all) and then retrieves the GL code combination. The Sales Tax Liability Account From/To parameters allow users to filter for these specific GL accounts, which are typically where the collected sales tax is posted before remittance to tax authorities.

3. Can this report help identify transactions where a sales tax exemption was incorrectly applied or missed?

Yes. By using the Exemption Status parameter, you can filter for both exempt and taxable transactions. Reviewing exempt transactions (and their supporting Exemption Certificate details, if included in the report) ensures proper application. Conversely, reviewing taxable transactions for which an exemption should have applied can highlight potential missed exemptions, leading to over-collection or incorrect billing.

Oracle E-Business Suite Reporting Library

We provide an open source Oracle EBS SQLs as a part of operational and project implementation support toolkits for rapid Excel reports generation.

Blitz Report™ is based on Oracle EBS forms technology, and hence requires minimal training. There are no data or performance limitations since the output files are created directly from the database without going through intermediate file formats such as XML.

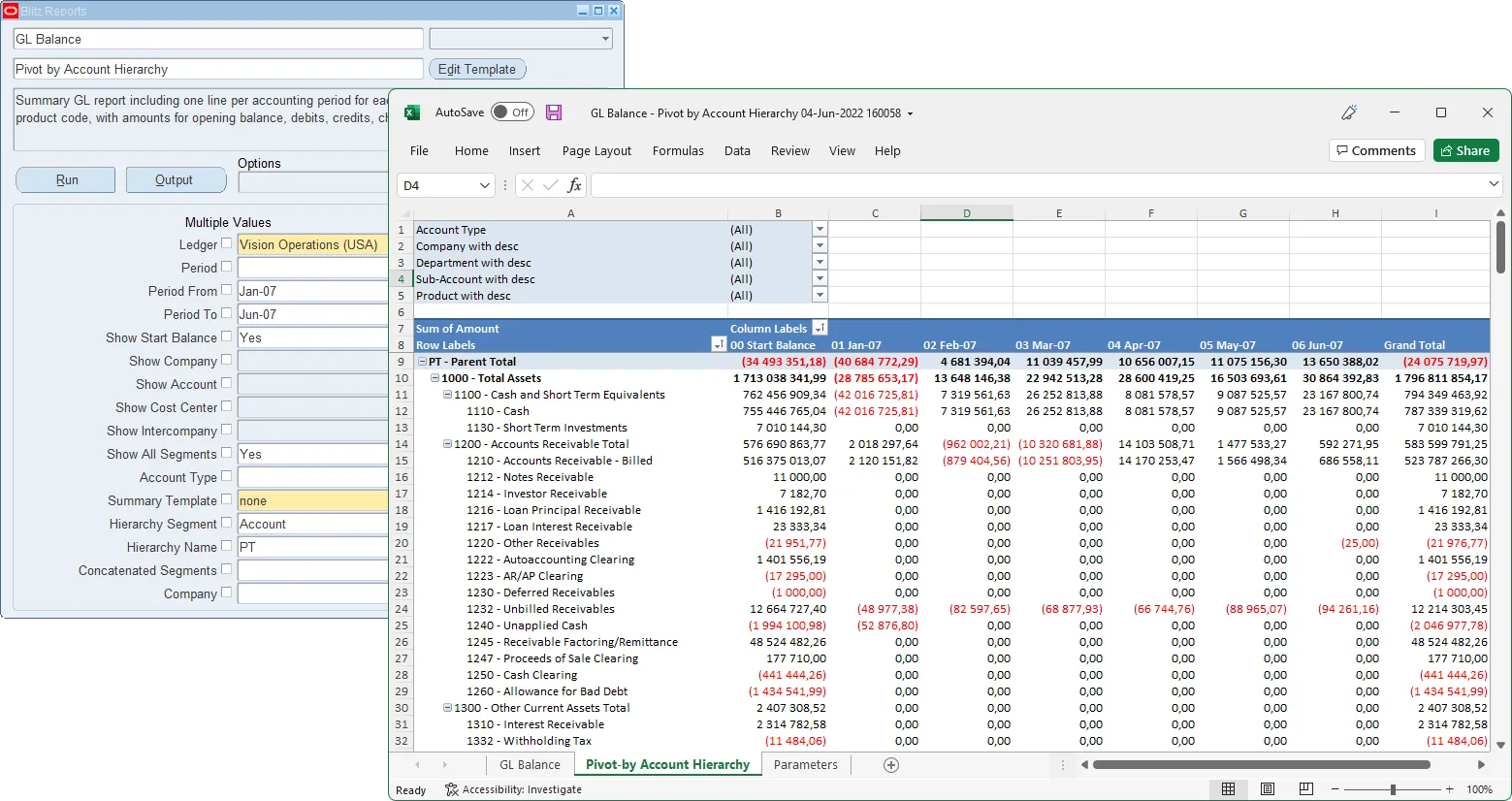

Blitz Report can be used as BI Publisher and Oracle Discoverer replacement tool. Standard Oracle BI Publisher and Discoverer reports can also be imported into Blitz Report for immediate output to Excel. Typically, reports can be created and version tracked within hours instead of days. The concurrent request output automatically opens upon completion without the need for re-formatting.

The Filters, Columns, Rows and Values fields are used to create and deliver the data in pivot table format with full drill down to details.

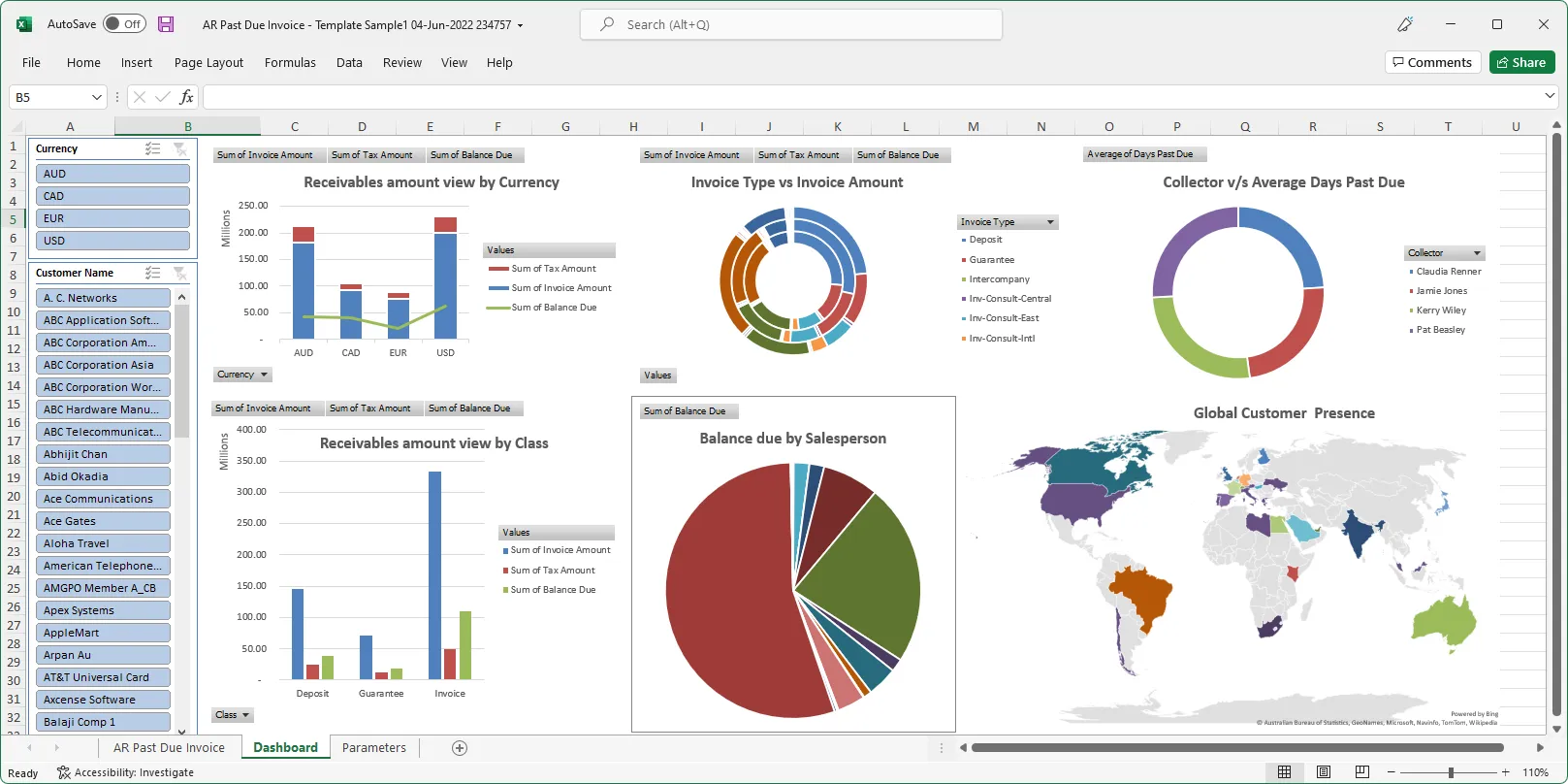

The Excel template upload functionality in Blitz Report allows users to create their own layouts by uploading an Excel template with additional sheets and charts, automatically refreshed when the report runs again. This allows to create custom dashboards and more advanced visualizations of report data.

You can download and use Blitz Report free of charge for your first 30 reports.

The installation and implementation process usually takes less than 1 hour; you can refer to our installation and user guides for specific details.

If you would like to optimize your Oracle EBS implementation and or operational reporting you can visit www.enginatics.com to review great ideas and example usage in blog. Or why not try for yourself in our demo environment.

Useful Links

Blitz Report™ – World’s fastest data upload and reporting for Oracle EBS

Oracle Discoverer replacement – importing worksheets into Blitz Report™

Blitz Report™ Questions & Answers

Supply Chain Hub by Blitz Report™

© 2025 Enginatics